US Airline Stock News: The Latest Trends and Predictions

author:US stockS -

The airline industry has always been a critical sector in the global economy, and the United States, with its extensive network of domestic and international flights, plays a pivotal role. In recent years, the performance of US airline stocks has been a hot topic among investors. This article delves into the latest trends and predictions in the US airline stock market, providing insights for those looking to stay ahead of the curve.

Rising Stock Prices Amidst Challenges

Despite the challenges posed by the COVID-19 pandemic, many US airlines have seen their stock prices rise significantly. This can be attributed to several factors. Firstly, the gradual recovery of the global economy has led to increased demand for air travel. Secondly, airlines have implemented cost-cutting measures and improved operational efficiency, which has positively impacted their financial performance.

Key Airlines and Their Stock Performance

United Airlines: United Airlines has been one of the top-performing US airlines in terms of stock prices. The company has successfully navigated the pandemic by implementing various cost-saving measures and focusing on customer experience. This has helped the airline maintain a strong financial position and attract investors.

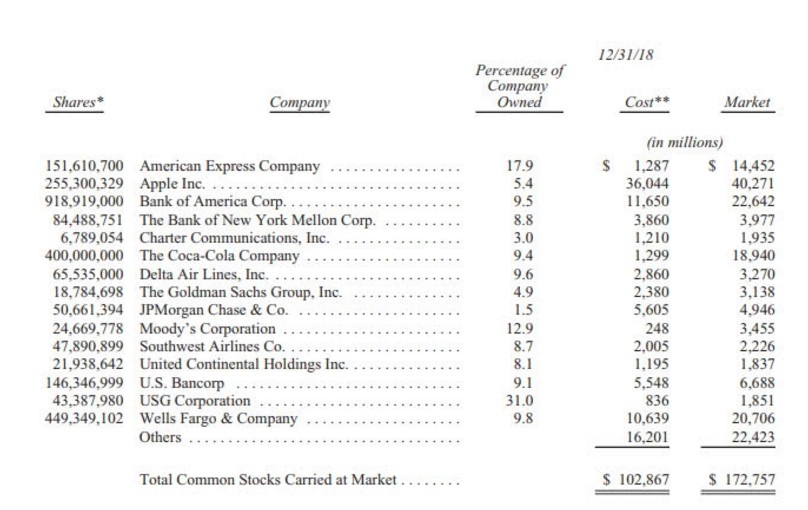

Delta Air Lines: Delta Air Lines has also seen a surge in its stock prices. The airline has been proactive in diversifying its revenue streams and has invested heavily in technology to improve customer satisfaction. These efforts have paid off, and the company has emerged as a leader in the industry.

American Airlines: American Airlines has faced several challenges during the pandemic, but it has managed to stabilize its financial position. The airline has been focusing on improving its operational efficiency and has been successful in attracting new customers.

Emerging Trends in the US Airline Stock Market

Increased Focus on Sustainability: As climate change becomes a growing concern, airlines are increasingly focusing on sustainability. This includes investing in more fuel-efficient aircraft and reducing carbon emissions. Airlines that prioritize sustainability are likely to attract environmentally conscious investors.

Expansion of Low-Cost Carriers: The rise of low-cost carriers has been a significant trend in the US airline industry. These carriers offer affordable flights, which has helped drive demand for air travel. Investors are keeping a close eye on the performance of these airlines, as they have the potential to disrupt the market.

Technological Innovation: Technology is playing a crucial role in the airline industry. Airlines that invest in technology are likely to improve their operational efficiency and customer experience. This has made technology a key factor for investors when evaluating airline stocks.

Conclusion

The US airline stock market is dynamic and complex, with several factors influencing stock prices. Despite the challenges posed by the pandemic, many airlines have managed to stabilize their financial positions and attract investors. As the industry continues to evolve, investors need to stay informed about the latest trends and predictions to make informed decisions.

us stock market live