Stock Market Update US: The Latest Trends and Insights

author:US stockS -

Introduction

The stock market is a dynamic entity that constantly evolves, reflecting the economic conditions, investor sentiment, and corporate performance. In this article, we delve into the latest updates from the US stock market, highlighting key trends and insights that investors should be aware of. Whether you are a seasoned investor or just starting out, staying informed about the market is crucial for making informed decisions.

Trends in the US Stock Market

Tech Stocks Leading the Charge

The technology sector has been a major driver of the US stock market, with companies like Apple, Microsoft, and Amazon leading the charge. These tech giants have continued to post strong earnings, driving their stock prices higher. The rise of remote work and digital transformation has further boosted the tech sector's growth prospects.

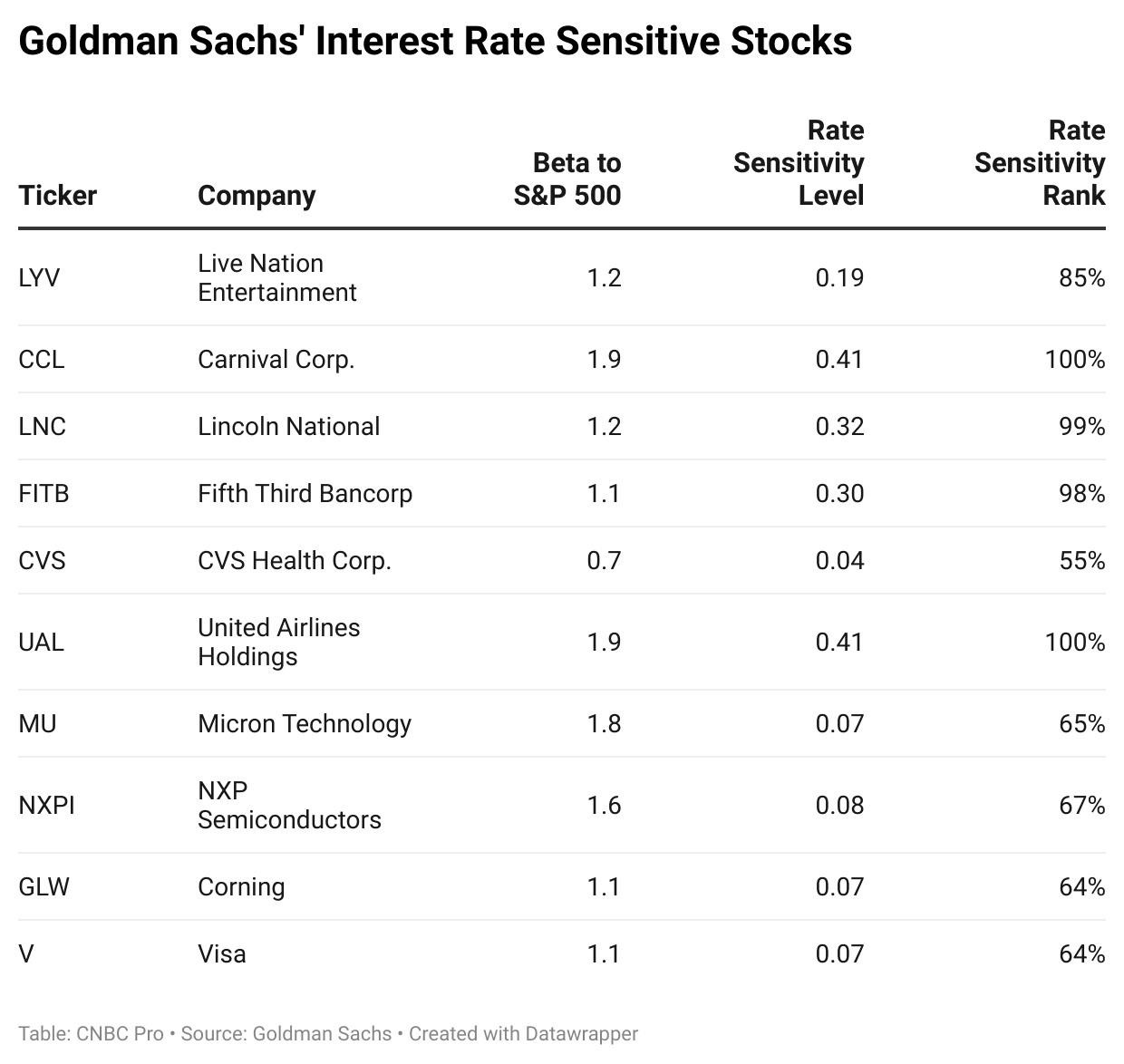

Rising Interest Rates

The Federal Reserve has been raising interest rates to combat inflation, which has had a mixed impact on the stock market. While higher interest rates can hurt growth stocks, they also benefit companies with strong balance sheets and steady cash flows. Investors should keep an eye on the Fed's policy decisions and their potential impact on the market.

Economic Recovery and Consumer Spending

The US economy is gradually recovering from the COVID-19 pandemic, with consumer spending playing a key role. As vaccination rates increase and restrictions ease, consumer confidence is on the rise, leading to higher retail sales and a positive outlook for the stock market.

Sector Rotation

Investors have been rotating into sectors that have been underperforming, such as financials, real estate, and energy. This shift is driven by expectations of a stronger economic recovery and increased corporate profits.

Insights for Investors

Diversification

Diversification is key to managing risk in the stock market. Investors should consider allocating their investments across different sectors, geographies, and asset classes to minimize the impact of market volatility.

Long-term Perspective

The stock market can be unpredictable in the short term, but history has shown that investing for the long term can lead to substantial returns. Investors should focus on their long-term goals and not be swayed by short-term market fluctuations.

Evaluating Valuations

It's important to evaluate the valuations of stocks before making investment decisions. Overvalued stocks can be risky, especially in a market environment with rising interest rates.

Monitoring News and Economic Indicators

Staying informed about market news and economic indicators can help investors make more informed decisions. Keeping an eye on factors like inflation, unemployment rates, and corporate earnings reports is crucial.

Case Study: Tesla

One notable case study is Tesla, the electric vehicle manufacturer. Despite facing challenges and skepticism in the past, Tesla has continued to grow at a rapid pace. The company's innovative approach, strong brand, and increasing demand for electric vehicles have contributed to its remarkable stock performance.

In conclusion, the US stock market is currently characterized by strong tech stocks, rising interest rates, and a recovering economy. Investors should focus on diversification, long-term investing, and staying informed about market trends and economic indicators. By doing so, they can navigate the complexities of the stock market and achieve their investment goals.

us stock market live