Stock Market Outlook: July 2025 in the US

author:US stockS -

As we approach the latter half of 2025, investors are keenly focused on the stock market outlook for the United States. With economic indicators pointing towards a mix of opportunities and challenges, it's crucial to understand the potential trends and sectors that could shape the market in July 2025.

Economic Indicators and Trends

Economic indicators such as unemployment rates, inflation, and GDP growth are critical factors that influence the stock market. In July 2025, the US economy is expected to be on a steady growth path, with unemployment rates at or below 4% and inflation under control. This favorable economic backdrop suggests a positive outlook for the stock market.

Sector Analysis

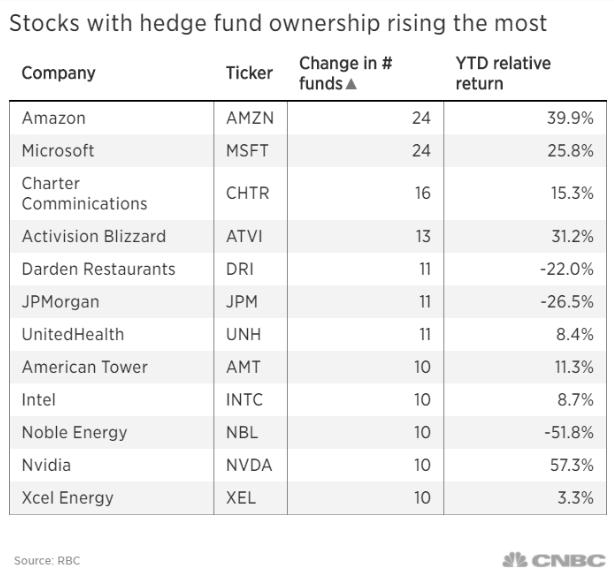

Technology Sector: The technology sector remains a key driver of the US stock market. Companies like Apple, Microsoft, and Amazon continue to dominate the industry, with strong growth prospects. In July 2025, the tech sector is expected to see significant gains, driven by advancements in artificial intelligence, cloud computing, and 5G technology.

Healthcare Sector: The healthcare sector is another area with strong growth potential. With an aging population and the increasing demand for medical services, companies in this sector are poised for significant growth. Biotech companies and pharmaceutical giants like Pfizer and Johnson & Johnson are expected to lead the charge.

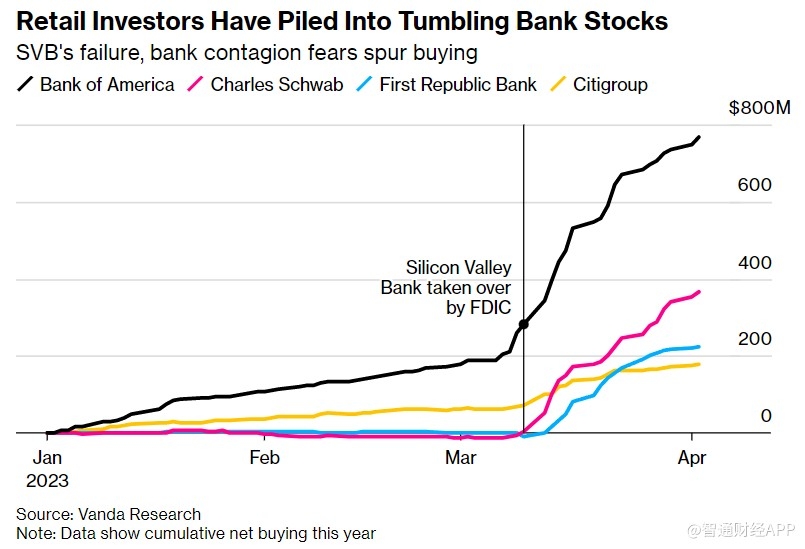

Financial Sector: The financial sector is expected to remain stable in July 2025. With low interest rates and a growing economy, banks and financial institutions are likely to see moderate growth. Companies like JPMorgan Chase and Bank of America are well-positioned to benefit from this trend.

Emerging Sectors

Renewable Energy: The renewable energy sector is gaining traction, driven by increasing environmental concerns and government incentives. Companies involved in solar, wind, and hydroelectric power are expected to see significant growth in July 2025.

Cybersecurity: As cyber threats continue to rise, the cybersecurity sector is becoming increasingly important. Companies specializing in cybersecurity solutions are expected to see strong growth, with demand driven by both businesses and consumers.

Case Studies

Tesla: Tesla, a leader in electric vehicles and renewable energy, has seen significant growth in recent years. In July 2025, the company is expected to continue its upward trajectory, driven by increasing demand for electric vehicles and its expansion into new markets.

Shopify: Shopify, a leading e-commerce platform, has seen rapid growth due to the increasing popularity of online shopping. In July 2025, the company is expected to continue its growth momentum, driven by a strong pipeline of new customers and partnerships.

Conclusion

As we approach July 2025, the US stock market outlook appears positive, with opportunities across various sectors. Investors should focus on technology, healthcare, and financial sectors, as well as emerging sectors like renewable energy and cybersecurity. By staying informed and investing strategically, investors can position themselves for success in the coming months.

us stock market live