Hyundai Stock in US: A Comprehensive Analysis

author:US stockS -

In the dynamic world of global investments, the stock market performance of Hyundai, a leading automaker, has always been a topic of interest for investors. The stock of Hyundai in the US has witnessed significant fluctuations over the years, making it a crucial area for analysis. This article delves into the factors influencing Hyundai's stock performance in the US, its market position, and potential future trends.

Understanding Hyundai's Stock Performance in the US

Hyundai Motor Company, a South Korean multinational automotive manufacturer, has been a key player in the global automotive industry for decades. Its stock performance in the US has been influenced by various factors, including market demand, economic conditions, and geopolitical events.

Market Demand

One of the primary factors affecting Hyundai's stock performance in the US is market demand. The company has a strong presence in the US market, with a wide range of vehicles catering to diverse consumer needs. The introduction of new models, such as the Hyundai Santa Fe and the Hyundai Kona, has helped the company maintain its market share.

Economic Conditions

Economic conditions, both in the US and globally, play a crucial role in determining Hyundai's stock performance. During economic downturns, consumers tend to cut back on discretionary spending, which can negatively impact car sales. Conversely, during economic upswings, car sales often see a significant boost.

Geopolitical Events

Geopolitical events, such as trade disputes and political instability, can also impact Hyundai's stock performance. For instance, the US-China trade war has led to higher tariffs on imported vehicles, affecting Hyundai's profitability.

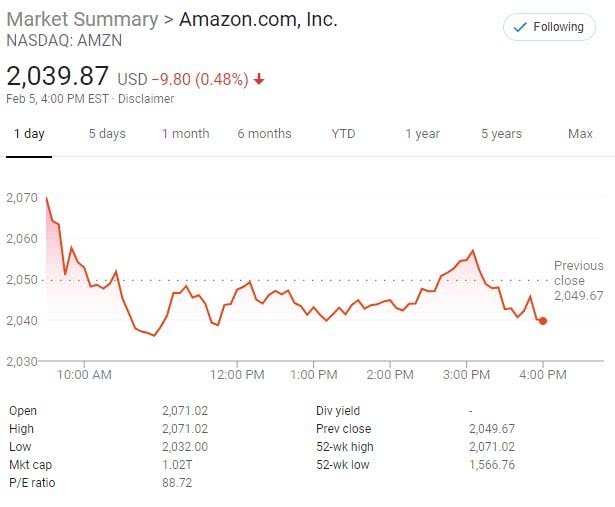

Analyzing Hyundai's Stock Performance

To better understand Hyundai's stock performance in the US, let's take a look at some key metrics:

Market Capitalization

Hyundai's market capitalization has seen significant growth over the years, reflecting its strong position in the global automotive industry. As of the latest data, the market capitalization of Hyundai stands at around $58 billion.

Earnings Per Share (EPS)

Hyundai's earnings per share (EPS) has been on an upward trend, indicating the company's profitability. The EPS for the past fiscal year was approximately $6.80, a significant increase from the previous year.

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is a key metric used to evaluate a company's stock performance. Hyundai's P/E ratio currently stands at around 10, which is considered a reasonable value.

Comparative Analysis

To put Hyundai's stock performance in perspective, let's compare it with its main competitors in the US market:

- Toyota: Toyota's stock has seen steady growth over the years, with a market capitalization of around

237 billion and an EPS of approximately 6.50. - Ford: Ford's stock has been more volatile, with a market capitalization of around

45 billion and an EPS of approximately 2.50.

Future Outlook

Looking ahead, Hyundai's stock performance in the US is expected to be influenced by several factors:

- Electric Vehicles (EVs): Hyundai has been investing heavily in EV technology, which could drive future growth.

- Global Economic Conditions: Economic conditions in the US and globally will continue to play a crucial role in determining Hyundai's stock performance.

- Competition: The competitive landscape in the automotive industry is evolving, and Hyundai will need to stay ahead of its competitors to maintain its market share.

In conclusion, Hyundai's stock performance in the US is a complex issue influenced by various factors. By understanding these factors and analyzing key metrics, investors can gain valuable insights into Hyundai's stock potential.

us stock market live