Maximizing Your Retirement Fund: 75% US Stock Market Allocation

author:US stockS -

Understanding the Importance of Retirement Fund Allocation

As you approach retirement, it's crucial to make informed decisions about how to allocate your retirement fund. One popular strategy is to invest a significant portion, such as 75%, in the US stock market. This article delves into the reasons behind this allocation and how it can benefit your retirement portfolio.

Why Allocate 75% of Your Retirement Fund to the US Stock Market?

The US stock market has historically offered some of the highest returns compared to other investment options. By allocating a substantial portion of your retirement fund to the US stock market, you can potentially maximize your returns and ensure a comfortable retirement.

1. Historical Performance

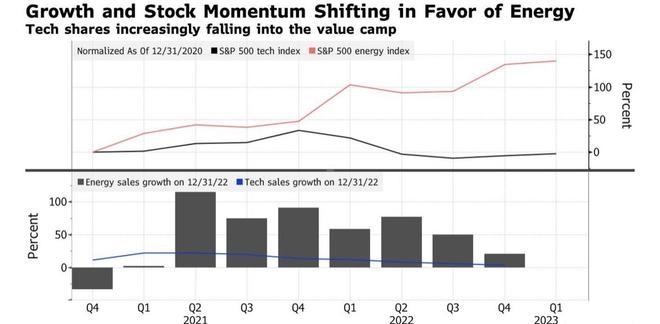

Over the long term, the US stock market has shown remarkable growth. For instance, the S&P 500, a widely followed stock market index, has returned an average of around 10% annually over the past century. This means that by investing in a diversified portfolio of US stocks, you can benefit from the strong performance of the market.

2. Diversification

Diversification is key to managing risk in your retirement fund. By allocating a significant portion to the US stock market, you can diversify your investments across various sectors and industries. This helps mitigate the risk of a single stock or sector underperforming.

3. Inflation Protection

The US stock market has historically outperformed inflation. This means that your investments can grow at a rate higher than the rate of inflation, ensuring that your purchasing power is preserved over time.

4. Potential for High Returns

The US stock market offers a wide range of investment opportunities, including blue-chip companies, emerging growth stocks, and sector-specific investments. By diversifying your investments within the stock market, you can potentially achieve high returns that can significantly boost your retirement fund.

Best Practices for Allocating 75% of Your Retirement Fund to the US Stock Market

To effectively allocate 75% of your retirement fund to the US stock market, consider the following best practices:

1. Diversify Your Stock Investments

Diversify your investments across various sectors and industries to mitigate risk. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to achieve a well-rounded portfolio.

2. Regularly Review and Rebalance Your Portfolio

As your retirement approaches, regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals. This may involve adjusting the percentage of your stock market allocation.

3. Stay Informed

Stay informed about market trends and economic indicators to make informed investment decisions. Utilize financial news sources, market research, and expert opinions to stay updated.

Case Study: John’s Retirement Fund Allocation

John, a 45-year-old investor, decided to allocate 75% of his retirement fund to the US stock market. By diversifying his investments across various sectors and regularly rebalancing his portfolio, he was able to achieve a significant return on his investments. As a result, John's retirement fund grew substantially, providing him with a comfortable retirement.

In conclusion, allocating 75% of your retirement fund to the US stock market can be a strategic move to maximize your returns and ensure a comfortable retirement. By diversifying your investments, staying informed, and regularly rebalancing your portfolio, you can make the most of this allocation strategy.

us stock market live