Understanding the Total Stock Market US Stock Mutual Fund

author:US stockS -

In the intricate world of investments, a total stock market US stock mutual fund stands out as a powerful tool for investors seeking to diversify their portfolios. This fund offers a gateway to a broad spectrum of U.S. equities, providing a balanced approach to growth and income. Let's delve into what makes this investment vehicle so appealing and how it can be a cornerstone of your financial strategy.

What is a Total Stock Market US Stock Mutual Fund?

A total stock market US stock mutual fund is a type of investment vehicle that pools money from numerous investors to buy a wide range of stocks across the entire U.S. stock market. This includes all publicly traded companies, regardless of their size or industry. The objective of this fund is to provide investors with exposure to the overall market, aiming to capture the growth potential of the U.S. economy.

Benefits of Investing in a Total Stock Market US Stock Mutual Fund

1. Diversification:

2. Professional Management: These funds are managed by professional investment managers who have the expertise and resources to actively monitor and adjust the fund's holdings. This can be particularly beneficial for investors who lack the time or knowledge to manage their own stock portfolios.

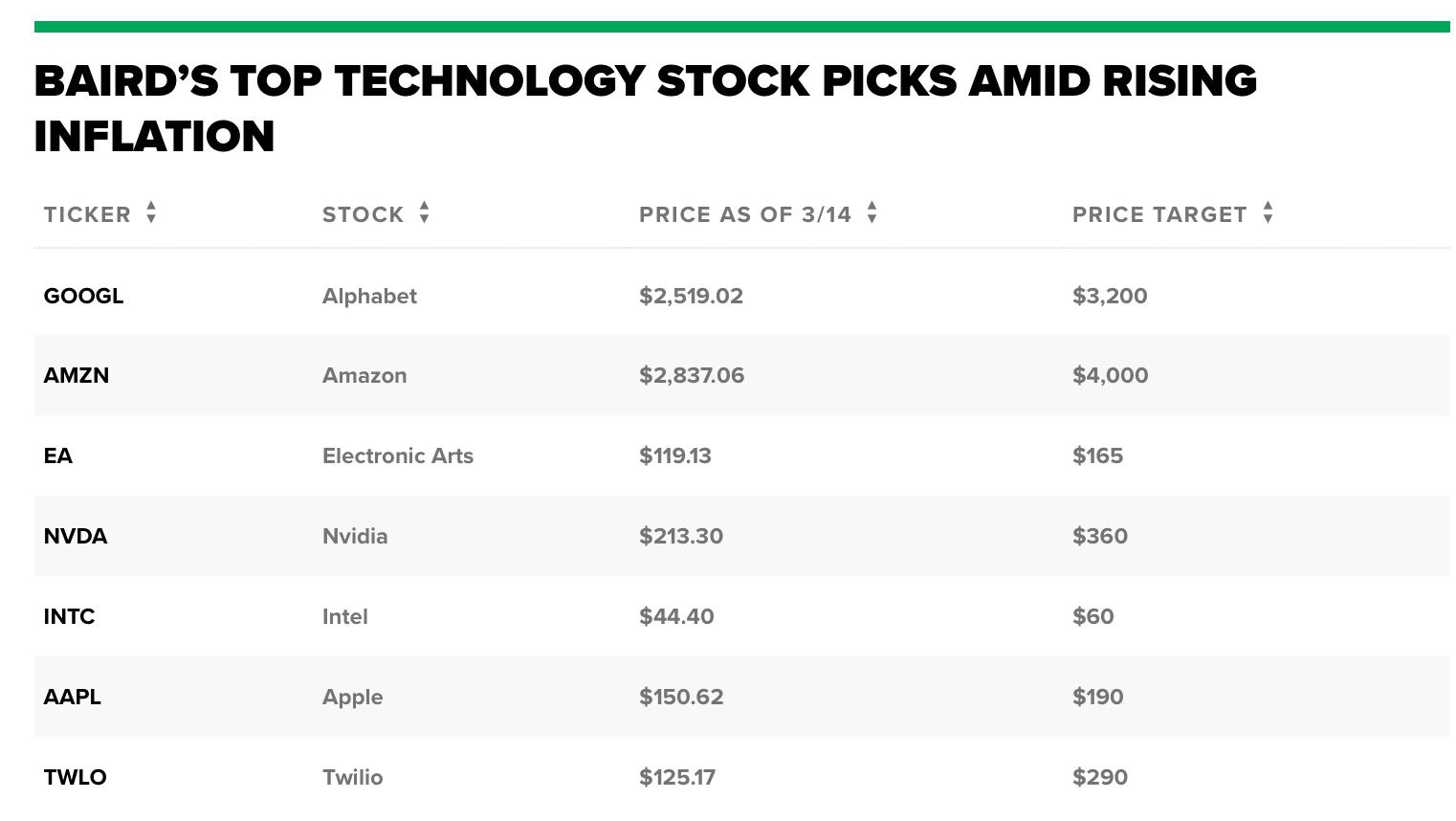

3. Accessibility: Investing in a total stock market US stock mutual fund offers accessibility to the U.S. stock market, which can be challenging for individual investors to access on their own. This allows investors to participate in the growth potential of the market without having to buy and sell individual stocks.

4. Lower Costs: Compared to purchasing individual stocks, investing in a mutual fund can be more cost-effective. Mutual funds often have lower transaction costs and fees compared to buying and selling individual stocks.

5. Potential for Growth: Historically, the U.S. stock market has provided one of the highest returns among global markets. By investing in a total stock market US stock mutual fund, investors can potentially benefit from the long-term growth of the U.S. economy.

Case Study: Vanguard Total Stock Market Index Fund

A prime example of a total stock market US stock mutual fund is the Vanguard Total Stock Market Index Fund. This fund tracks the performance of the CRSP U.S. Total Market Index, which includes all U.S. stocks with a market capitalization of $10 million or more. Since its inception, this fund has provided investors with a diversified and low-cost way to access the U.S. stock market.

Conclusion

Investing in a total stock market US stock mutual fund can be a strategic move for investors seeking to diversify their portfolios and gain exposure to the U.S. stock market. With professional management, lower costs, and the potential for growth, this investment vehicle offers a compelling opportunity for investors of all levels.

us stock market live