LG Chem Ltd Stock Price US: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of technology and innovation, LG Chem Ltd has emerged as a key player in the global market. As investors and market enthusiasts keep a keen eye on the company's stock performance, it's crucial to understand the factors that influence the LG Chem Ltd stock price in the US. This article delves into the key aspects that impact the stock price, providing a comprehensive analysis for those interested in investing in LG Chem Ltd.

Understanding LG Chem Ltd

LG Chem Ltd, a subsidiary of LG Group, is a South Korean multinational chemical company specializing in the production of petrochemicals, battery materials, and other high-tech materials. The company operates in various segments, including petrochemicals, battery materials, and others. With a strong presence in the global market, LG Chem Ltd has become a significant player in the industry.

Factors Influencing LG Chem Ltd Stock Price

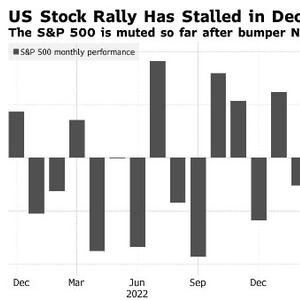

Market Trends: The stock price of LG Chem Ltd is heavily influenced by market trends. As the global market for battery materials and petrochemicals continues to grow, the company's stock price tends to rise. Conversely, during economic downturns or market volatility, the stock price may experience downward pressure.

Company Performance: The financial performance of LG Chem Ltd plays a crucial role in determining its stock price. Factors such as revenue growth, profit margins, and earnings per share (EPS) are closely monitored by investors. A strong financial performance often leads to a higher stock price.

Industry News: Any news related to the petrochemical or battery materials industry can have a significant impact on LG Chem Ltd's stock price. For instance, advancements in battery technology or changes in government policies can positively or negatively affect the company's prospects.

Currency Fluctuations: As LG Chem Ltd is a South Korean company, currency fluctuations between the Korean won and the US dollar can impact the stock price. A weaker won can make the company's products more competitive in the US market, potentially boosting the stock price.

Competitive Landscape: The competitive landscape in the petrochemical and battery materials industry can also influence LG Chem Ltd's stock price. A strong competitive position can lead to higher market share and profitability, while intense competition may put downward pressure on the stock price.

Case Study: LG Chem Ltd's Stock Price Performance

To illustrate the impact of various factors on LG Chem Ltd's stock price, let's consider a recent case study. In 2020, the global market for battery materials experienced significant growth due to the increasing demand for electric vehicles (EVs). As a result, LG Chem Ltd's stock price surged, reaching an all-time high. This surge can be attributed to the company's strong position in the battery materials market and its strategic focus on EV-related products.

Conclusion

Investing in LG Chem Ltd requires a thorough understanding of the factors that influence its stock price. By keeping a close eye on market trends, company performance, industry news, currency fluctuations, and the competitive landscape, investors can make informed decisions. As the global market for battery materials and petrochemicals continues to grow, LG Chem Ltd remains a compelling investment opportunity for those looking to capitalize on the company's strong performance and strategic focus.

us stock market live