Lloyds Banking Group Stock: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of finance, staying informed about the stock market is crucial for investors. One such company that has garnered significant attention is Lloyds Banking Group. This article delves into the details of Lloyds Banking Group stock, offering insights into its performance, market trends, and potential future prospects.

Understanding Lloyds Banking Group

Lloyds Banking Group is a leading financial institution based in the United Kingdom. It is one of the "Big Four" banks in the UK, along with HSBC, Barclays, and the Royal Bank of Scotland. The group operates through various segments, including retail banking, commercial banking, and international banking.

Lloyds Banking Group Stock Performance

When analyzing Lloyds Banking Group stock, it is essential to consider its historical performance. Over the past few years, the stock has experienced fluctuations, reflecting the broader market trends and the specific dynamics of the financial sector.

Market Trends

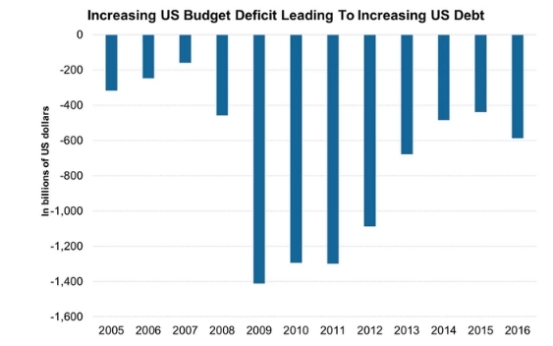

Several factors have influenced the performance of Lloyds Banking Group stock. One significant trend has been the regulatory environment. Following the 2008 financial crisis, stricter regulations were imposed on banks, impacting their profitability. However, Lloyds has demonstrated resilience, adapting to these changes and maintaining a strong presence in the market.

Dividend Yield

Another crucial aspect of Lloyds Banking Group stock is its dividend yield. The company has a long history of paying dividends to its shareholders, making it an attractive investment for income-seeking investors. Over the past few years, the dividend yield has remained relatively stable, offering investors a consistent stream of income.

Comparative Analysis

To gain a better understanding of Lloyds Banking Group's stock performance, it is helpful to compare it with its peers. When compared to other major UK banks, Lloyds Banking Group has generally maintained a competitive position, although it has faced challenges in certain areas.

Future Prospects

Looking ahead, the future prospects for Lloyds Banking Group stock appear promising. The company is well-positioned to benefit from the UK's economic recovery, as well as the growing demand for financial services. Additionally, the group's ongoing efforts to streamline its operations and improve efficiency are expected to contribute to its long-term growth.

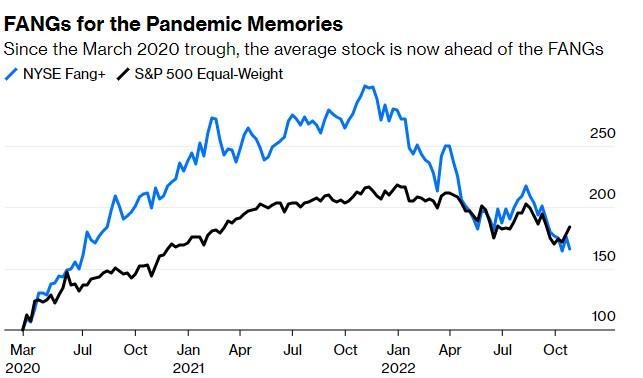

Case Study: Lloyds Banking Group's Response to the Pandemic

One notable example of Lloyds Banking Group's resilience is its response to the COVID-19 pandemic. As the pandemic hit, the company faced significant challenges, including increased loan defaults and reduced revenue. However, Lloyds quickly adapted, implementing measures to support its customers and employees. This proactive approach helped the company navigate the crisis and emerge stronger.

Conclusion

In conclusion, Lloyds Banking Group stock presents a compelling investment opportunity for investors looking to gain exposure to the financial sector. With a strong track record, stable dividend yield, and promising future prospects, Lloyds Banking Group is a company worth considering for your investment portfolio.

us stock market live