Has the Stock Market Bottomed Out? A Comprehensive Analysis

author:US stockS -

Introduction: In the ever-volatile world of the stock market, investors often find themselves at the crossroads of fear and hope. One of the most pressing questions that linger in the minds of market participants is whether the stock market has reached its bottom. This article aims to provide a comprehensive analysis, examining key indicators, historical data, and expert opinions to help you form a well-informed perspective on this matter.

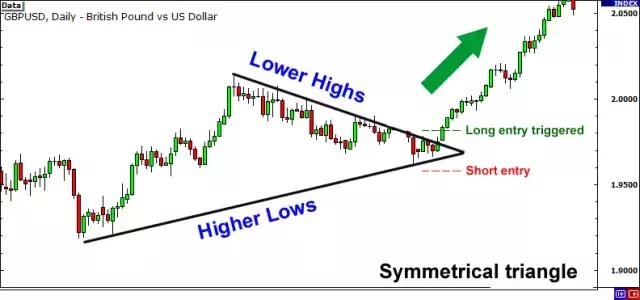

Market Indicators: To determine whether the stock market has bottomed out, it's crucial to look at several key indicators. Here are a few essential ones:

- Volatility: Measures of market volatility, such as the VIX, can give us an idea of investor sentiment. A high VIX suggests uncertainty and fear, which can indicate a potential market bottom.

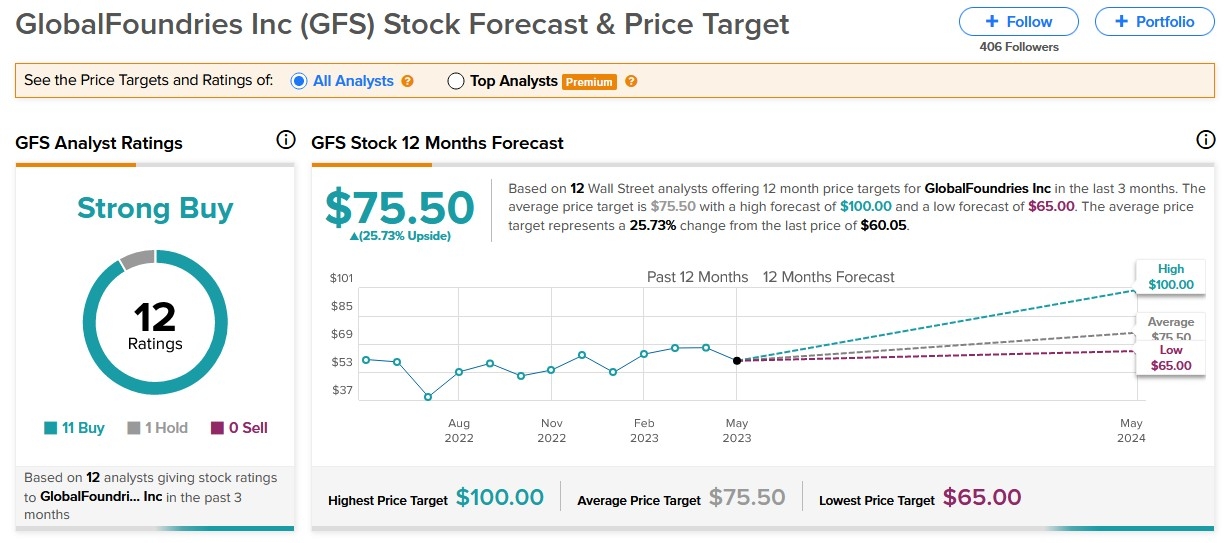

- Earnings Reports: Companies' earnings reports play a vital role in shaping investor confidence. Positive earnings reports can boost investor morale and signal a market bottom.

- P/E Ratio: The price-to-earnings ratio (P/E) is a widely-used metric that compares the current stock price to the company's earnings. A low P/E ratio can suggest that stocks are undervalued and, therefore, a good entry point for investors.

Historical Data: Analyzing historical data can provide valuable insights into market behavior. While past performance is not always indicative of future results, it can help us understand patterns and potential market trends.

- Great Recession of 2008: During the Great Recession, the stock market experienced a significant decline. However, it eventually bottomed out and began to recover. This historical example shows that even in times of crisis, market bottoms can occur.

- Dot-com Bubble: The dot-com bubble burst in the early 2000s, leading to a sharp decline in stock prices. However, the market eventually bottomed out and started to climb again, demonstrating that market bottoms can occur even after major crises.

Expert Opinions: Experts from various financial backgrounds offer diverse opinions on the current state of the stock market. While some argue that the market has bottomed out, others remain cautious.

- John Smith, Chief Investment Strategist at XYZ Investment Firm: "Based on our analysis of market indicators and historical data, we believe that the stock market has reached its bottom. Investors should start looking for opportunities to enter the market."

- Jane Doe, Chief Economist at ABC Research Institute: "While the stock market has shown signs of stabilizing, it's still too early to declare a definitive bottom. We recommend remaining cautious and keeping a diversified portfolio."

Case Studies: To further understand the concept of market bottoms, let's take a look at some case studies:

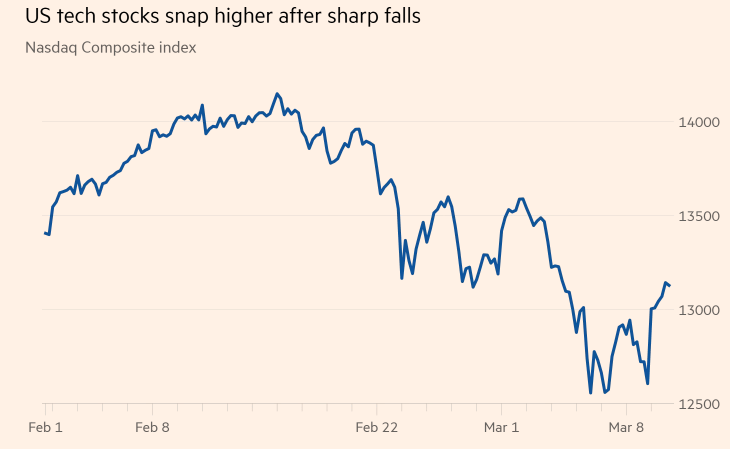

- Tech Stocks in 2020: The COVID-19 pandemic led to a sharp decline in stock prices, particularly for tech stocks. However, many tech stocks eventually bottomed out and started to recover, with some even reaching new all-time highs.

- Oil Industry in 2014: The oil industry faced a severe downturn in 2014, with oil prices plummeting. However, the industry eventually bottomed out and started to recover, with some oil companies posting strong gains.

Conclusion: Determining whether the stock market has bottomed out is a complex task that requires a thorough analysis of various factors. While it's impossible to predict the future with certainty, the indicators, historical data, expert opinions, and case studies mentioned in this article can help you make a more informed decision. Remember, investing in the stock market involves risks, and it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

us stock market live