Marc Faber on US Stocks: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of financial markets, investors are always on the lookout for insights from industry experts. Marc Faber, renowned for his bearish outlook and insightful predictions, has been a key figure in the investment community. This article delves into Marc Faber's views on US stocks, providing a comprehensive analysis of his perspectives and predictions.

Understanding Marc Faber's Perspective

Marc Faber, also known as "Dr. Doom," is a Swiss investor and publisher of the "Gloom, Boom & Doom Report." His bearish outlook on markets has often painted a gloomy picture, but his predictions have also proven to be quite accurate at times. Faber's views on US stocks are shaped by his belief that markets are driven by economic cycles and investor psychology.

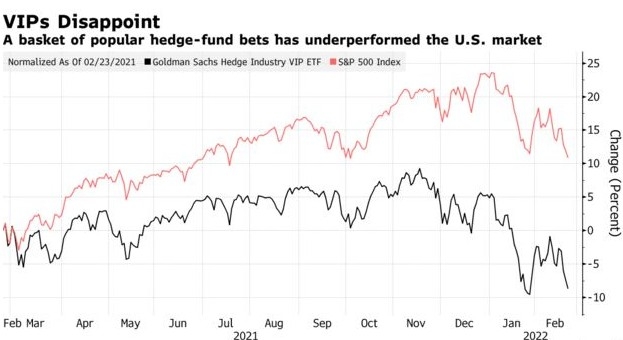

The Current State of US Stocks

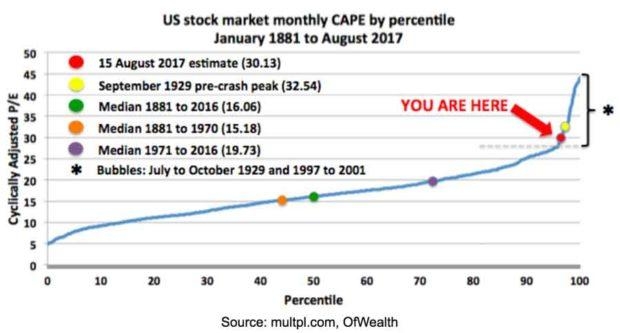

According to Marc Faber, the US stock market is currently in a speculative bubble. He believes that the market has become overvalued due to excessive leverage and low interest rates. Faber argues that this bubble is similar to the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s, both of which ended in dramatic market crashes.

Key Factors Contributing to the Bubble

Faber identifies several key factors contributing to the current speculative bubble in US stocks:

- Low Interest Rates: The Federal Reserve's policy of keeping interest rates low has encouraged investors to seek higher returns in riskier assets, such as stocks.

- Excessive Debt: The high levels of debt in the US economy have put pressure on corporate profits and increased the risk of a financial crisis.

- Investor Psychology: The current bull market has created a sense of complacency among investors, leading them to take on excessive risk.

Potential Implications of the Bubble

Faber warns that the current speculative bubble in US stocks could lead to a significant market correction. He predicts that when the bubble bursts, it could lead to a bear market similar to the 2008 financial crisis. This could have far-reaching implications for the global economy, including rising unemployment, falling asset prices, and a potential recession.

Case Studies: Past Market Crashes

To illustrate his point, Faber refers to past market crashes, such as the dot-com bubble and the housing bubble, as examples of speculative bubbles that eventually burst. He notes that these crashes were preceded by similar conditions, such as excessive leverage and investor optimism, which led to a sudden loss of confidence and a sharp decline in asset prices.

Investment Strategies for the Future

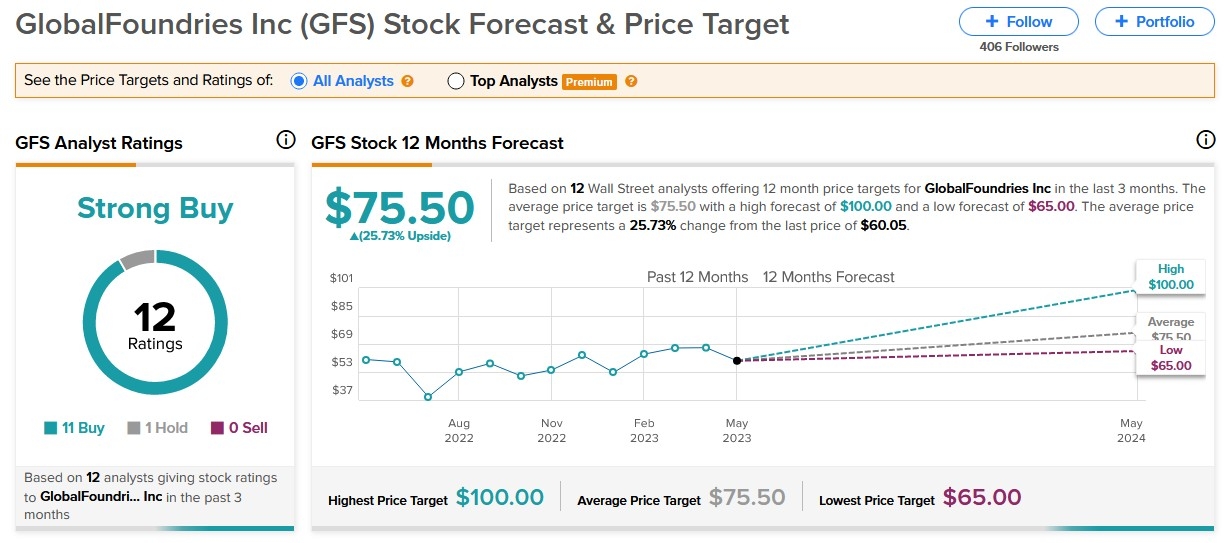

In light of his bearish outlook on US stocks, Faber recommends that investors adopt a conservative investment strategy. He suggests diversifying their portfolios with undervalued assets, such as commodities, emerging market stocks, and real estate. Faber also advises investors to avoid highly leveraged companies and sectors that are prone to market volatility.

Conclusion

Marc Faber's views on US stocks offer a valuable perspective on the current market conditions. While his bearish outlook may seem pessimistic, his insights are based on a thorough analysis of market trends and historical patterns. As investors navigate the volatile landscape of the financial markets, it is crucial to consider the opinions of experts like Marc Faber to make informed decisions.

us stock market live