Adani Group Stocks Surge Amid Volatility Post US Indictment

author:US stockS -

The Adani Group, one of India's largest conglomerates, has seen its stocks soar amidst a period of market volatility following the recent US indictment. This article delves into the reasons behind the surge and examines the potential impact of the legal action on the group's future.

Market Volatility and Stock Surge

The Adani Group's stocks have experienced a rollercoaster ride in recent weeks. While the group has faced a number of challenges, including the US indictment, its shares have managed to climb higher. This surge can be attributed to several factors, including strong fundamentals, investor optimism, and a desire for exposure to one of India's most influential conglomerates.

Strong Fundamentals

The Adani Group boasts a diverse portfolio of businesses, including ports, airports, energy, and logistics. These businesses have been performing well, with strong revenue growth and profitability. This has provided a solid foundation for the group's stocks, making them attractive to investors despite the recent legal challenges.

Investor Optimism

Despite the US indictment, investors remain optimistic about the Adani Group's future. Many believe that the group has the resources and resilience to overcome the legal hurdles and continue to grow. This optimism has been reflected in the stock price, which has surged in recent weeks.

Desire for Exposure to India's Largest Conglomerate

The Adani Group is one of India's most influential conglomerates, with a significant presence in key sectors of the economy. Investors are eager to gain exposure to this powerful group, which is why they have continued to buy its stocks despite the recent legal challenges.

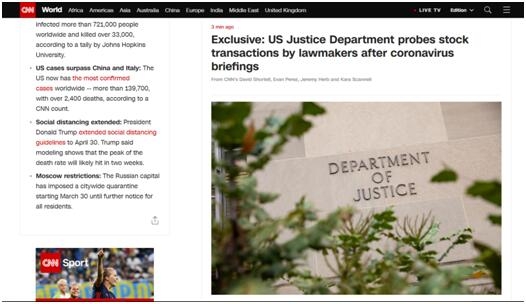

US Indictment: A Brief Overview

The US indictment against the Adani Group involves allegations of fraud and corruption. The group has denied all charges, and has vowed to fight the allegations in court. Despite the legal challenges, the group has maintained its operations and continues to grow.

Impact on the Group's Future

The US indictment has raised concerns about the Adani Group's future. However, many analysts believe that the group has the resources and expertise to navigate these challenges. If the group can successfully defend itself against the allegations, it could emerge stronger and more resilient.

Case Study: The Adani Group's Resilience

One example of the Adani Group's resilience is its ability to weather the global financial crisis of 2008. Despite the economic downturn, the group continued to grow and expand its operations. This demonstrates the group's ability to adapt to changing market conditions and overcome challenges.

Conclusion

The Adani Group's stocks have surged amidst a period of market volatility following the recent US indictment. While the group faces significant legal challenges, many investors remain optimistic about its future. As the group continues to navigate these challenges, it will be interesting to see how it performs and whether it can emerge stronger and more resilient.

us stock market live