US Stock Graph Summary

author:US stockS -

In the ever-evolving landscape of financial markets, understanding the performance of US stocks is crucial for investors. This article provides a comprehensive US stock graph summary that will help you get a clearer picture of market trends, stock performance, and potential investment opportunities. We will delve into the key indicators, highlight major movements, and analyze notable stock market milestones. Let’s dive in.

Market Performance Overview

The performance of the US stock market is often tracked using the S&P 500 index, which represents the top 500 publicly-traded companies in the United States. Over the past few years, the S&P 500 has experienced significant growth, with a few notable fluctuations.

In the first half of 2021, the index reached an all-time high, driven by strong economic recovery and improved corporate earnings. However, concerns over rising inflation and rising interest rates led to a correction in the market during the second half of the year. Despite this, the S&P 500 ended the year with a positive return, reflecting the resilience of the US stock market.

Key Indicators

Several indicators can provide insights into the US stock market’s performance. One of the most closely watched indicators is the VIX index, also known as the “fear index,” which measures market volatility. During times of high uncertainty, such as the COVID-19 pandemic, the VIX reached record-high levels. However, as the economy recovered and investor confidence improved, the VIX began to decline, indicating a more stable market.

Another critical indicator is the yield curve, which shows the relationship between short-term and long-term interest rates. In recent years, the yield curve has been inverted, suggesting a potential recession. However, this indicator is not always reliable, as past inversions have not always led to a recession.

Notable Movements

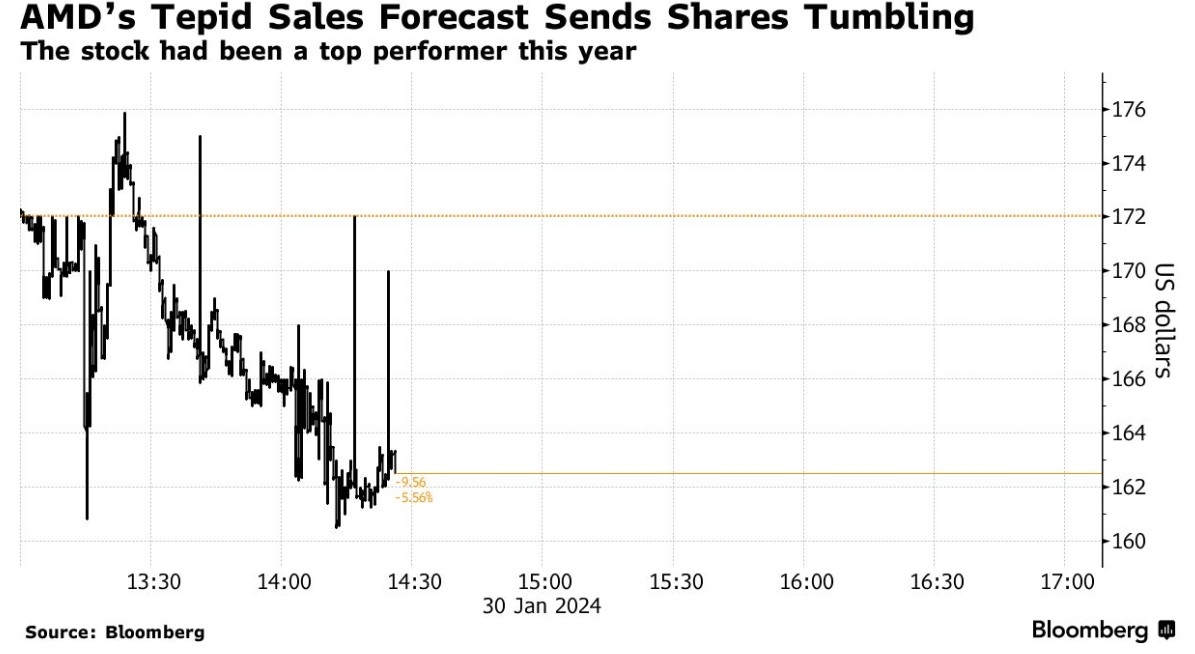

The US stock market has seen several notable movements over the past few years. One such movement was the rise of tech stocks, particularly those in the FAANG group (Facebook, Apple, Amazon, Netflix, and Google). These companies have seen significant growth and have become some of the most valuable in the world. However, the market has also seen the rise of small-cap stocks, offering investors more opportunities to diversify their portfolios.

Another major movement has been the increase in merger and acquisition activity, particularly in the tech industry. Companies are seeking to expand their market presence and gain access to new technologies by acquiring other businesses.

Case Studies

To better understand the impact of these movements, let’s consider a few case studies. Amazon has seen significant growth over the past decade, with its stock price soaring. The company has leveraged its technology and logistics expertise to become a global e-commerce giant. Another example is Tesla, which has become one of the most valuable companies in the world, thanks to its leadership in electric vehicles and renewable energy solutions.

Conclusion

Understanding the US stock graph is crucial for investors looking to make informed decisions. By analyzing key indicators, notable movements, and case studies, you can gain insights into market trends and potential investment opportunities. Keep in mind that the stock market is unpredictable, and investing always comes with risks. However, with a well-diversified portfolio and a clear understanding of market trends, you can increase your chances of success.

new york stock exchange