Are US Stocks Taxed in TFSA?

author:US stockS -

If you're considering investing in US stocks while holding them within a Tax-Free Savings Account (TFSA) in Canada, you might be wondering about the tax implications. This article delves into whether US stocks are taxed within a TFSA and provides valuable insights to help you make informed decisions about your investments.

Understanding TFSA and US Stocks

A TFSA is a tax-advantaged savings account available to Canadian residents. Contributions to a TFSA are not tax-deductible, but any investment growth, including dividends, interest, and capital gains, is tax-free when withdrawn. This makes it an attractive option for long-term savings and investment growth.

US stocks, on the other hand, are shares of companies based in the United States. Investing in US stocks can offer diversification and potential for higher returns, but it's essential to understand the tax implications when holding them within a TFSA.

Are US Stocks Taxed in TFSA?

The short answer is no, US stocks held within a TFSA are not taxed. The tax-free nature of a TFSA extends to all investments held within the account, including US stocks. This means that any dividends, interest, or capital gains earned from US stocks will remain tax-free, as long as they are not withdrawn from the TFSA.

Benefits of Holding US Stocks in a TFSA

Tax-Free Growth: The primary benefit of holding US stocks in a TFSA is the tax-free growth. This allows your investments to compound over time without the burden of taxes, potentially leading to higher returns.

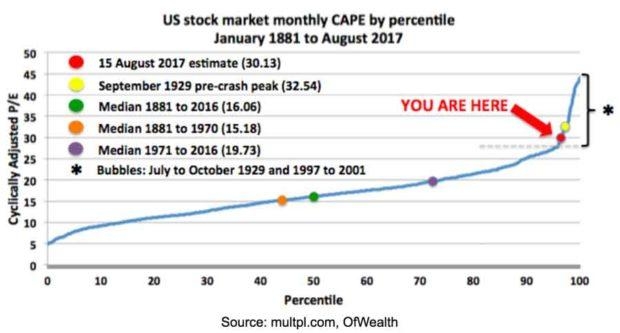

Diversification: Investing in US stocks can provide diversification to your portfolio, as the US market often performs differently from the Canadian market. This can help reduce risk and potentially increase returns.

Potential for Higher Returns: The US stock market has historically offered higher returns than the Canadian market. Holding US stocks in a TFSA allows you to benefit from these potential higher returns without paying taxes on the gains.

Considerations When Investing in US Stocks in a TFSA

Currency Fluctuations: Investing in US stocks involves exposure to currency fluctuations. If the Canadian dollar strengthens against the US dollar, you may experience a decrease in the value of your investments when converted back to Canadian dollars.

Dividend Taxation: While dividends earned from US stocks within a TFSA are tax-free, it's essential to consider the potential tax implications if you withdraw the dividends from the TFSA. Dividends are taxed at your marginal tax rate when withdrawn from a TFSA.

Transaction Costs: Investing in US stocks may involve additional transaction costs, such as brokerage fees and currency conversion fees. It's important to consider these costs when evaluating the overall performance of your investments.

Case Study: Investing in US Stocks in a TFSA

Let's consider a hypothetical scenario:

John invests

If John were to withdraw the $5,000 from his TFSA, he would not pay taxes on the gains. However, if he were to withdraw the dividends, he would be subject to his marginal tax rate on the amount withdrawn.

In this example, John benefits from the tax-free growth of his investments within his TFSA, allowing him to potentially increase his wealth over time.

In conclusion, US stocks held within a TFSA are not taxed, providing investors with a tax-advantaged way to grow their investments. While there are considerations to keep in mind, such as currency fluctuations and potential dividend taxation, the tax-free nature of a TFSA makes it an attractive option for long-term investment growth.

new york stock exchange