US Stock Futures Market Reaction: Decoding the Impact

author:US stockS -

In the fast-paced world of finance, the US stock futures market plays a pivotal role in shaping investor sentiment and market trends. This article delves into the intricacies of the US stock futures market, exploring its impact on the broader stock market and providing insights into how traders and investors can interpret market reactions.

Understanding US Stock Futures

What are US Stock Futures?

US stock futures are financial contracts that allow investors to buy or sell shares of a specific stock at a predetermined price on a future date. These contracts are often used for hedging purposes, but they also serve as a barometer for market sentiment.

Market Reactions: The Key Indicators

The US stock futures market offers several key indicators that traders and investors can use to gauge market sentiment and predict potential movements in the broader stock market.

1. Open Interest

Open interest refers to the total number of futures contracts that have not been settled or expired. An increase in open interest suggests growing optimism or pessimism in the market, depending on whether the number is rising or falling.

2. Implied Volatility

Implied volatility is a measure of the market's expectation of future price fluctuations. Higher implied volatility often indicates increased uncertainty and potential market volatility.

3. Price Action

Price action in the US stock futures market can provide valuable insights into market sentiment. For instance, a significant gap up or down in futures prices can indicate strong market sentiment.

Impact on the Broader Stock Market

The US stock futures market has a significant impact on the broader stock market. Here's how:

1. Leading Indicator

The US stock futures market often serves as a leading indicator of the broader stock market. A strong showing in futures can signal a positive day ahead for the stock market, while a weak showing can indicate potential challenges.

2. Market Sentiment

Market sentiment plays a crucial role in the stock market. The US stock futures market provides a glimpse into investor sentiment, which can influence trading decisions and market movements.

3. Market Volatility

The US stock futures market can influence market volatility. High volatility in futures can lead to increased volatility in the broader stock market.

Case Studies

To illustrate the impact of the US stock futures market, let's consider a few case studies:

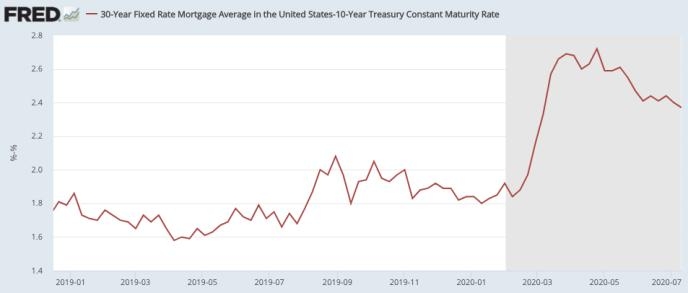

1. The 2020 Market Crash

In February 2020, the US stock futures market experienced a significant drop, signaling the start of the 2020 market crash. This drop was a leading indicator of the broader stock market's downward trend, which continued for several weeks.

2. The 2021 Tech Stock Boom

In 2021, the US stock futures market saw a surge in tech stocks, driven by strong performance in the tech sector. This surge in futures prices was a leading indicator of the broader stock market's upward trend in tech stocks.

Conclusion

The US stock futures market is a critical component of the financial landscape, providing valuable insights into market sentiment and potential market movements. By understanding the key indicators and their impact on the broader stock market, traders and investors can make more informed decisions and better navigate the volatile world of finance.

new york stock exchange