Should I Sell US Stocks Now?

author:US stockS -

In the ever-changing world of finance, investors often find themselves at a crossroads, contemplating whether or not to sell their US stocks. This decision is not one to be taken lightly, as it can have a significant impact on your investment portfolio. In this article, we'll explore the factors you should consider before deciding whether to sell your US stocks now.

Market Conditions and Trends

One of the primary factors to consider when deciding whether to sell your US stocks is the current market conditions and trends. Historically, markets tend to fluctuate over time, and understanding these patterns can help you make a more informed decision.

For instance, if you've seen a significant rise in stock prices over the past few months, you might be tempted to cash in on your gains. However, it's essential to evaluate whether this rise is due to long-term growth or short-term speculation. Keep an eye on economic indicators such as GDP, unemployment rates, and inflation, as these can provide valuable insights into the overall market health.

Economic Outlook

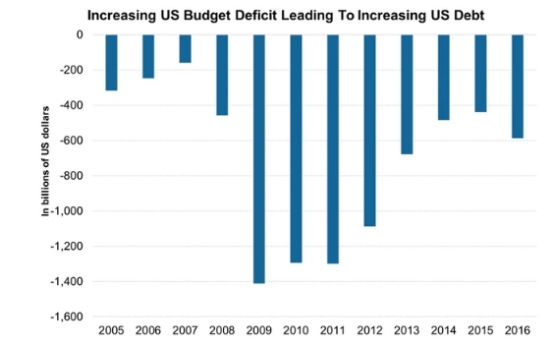

The economic outlook is another crucial factor to consider when deciding whether to sell your US stocks. Economic downturns can negatively impact stock prices, so it's important to stay informed about the latest economic news and forecasts.

For example, if there are signs of a looming recession, you might want to reconsider holding onto your stocks. On the other hand, if the economy is growing robustly, you may want to maintain or even increase your exposure to the market.

Dividends and Dividend Yields

If you're holding stocks for their dividends, it's important to consider the current dividend yields. A higher dividend yield can be a sign of a healthy stock, but it's also essential to evaluate the sustainability of the dividend payments.

Dividend cuts can occur for various reasons, including poor financial performance or a challenging economic environment. If you believe a dividend cut is imminent, it may be wise to sell your stocks before the market catches on.

Risk Tolerance

Your risk tolerance is a critical factor when deciding whether to sell your US stocks. If you're a conservative investor, you might prefer to avoid high-risk investments, even if they offer potentially high returns. In this case, selling your stocks could be a prudent move.

Conversely, if you're an aggressive investor, you might be comfortable holding onto your stocks, even during turbulent market conditions. In this scenario, selling might not be the best option.

Company Performance

Evaluating the performance of the individual companies you own is also essential when deciding whether to sell your stocks. Poor performance can be a sign that it's time to cut your losses, while strong performance might indicate that it's time to hold onto your stocks for the long term.

Diversification

Diversification is key to managing risk in your investment portfolio. If you're heavily invested in a particular sector or industry, consider selling some of your stocks to reduce your exposure and create a more balanced portfolio.

Conclusion

In conclusion, deciding whether to sell your US stocks is a complex decision that requires careful consideration of various factors. By staying informed about market conditions, economic outlooks, and the performance of the companies you own, you can make a more informed decision. Remember that investing is not a one-size-fits-all approach, and it's crucial to align your investment strategy with your risk tolerance and financial goals.

new york stock exchange