Title: US Stock Market: The Impact on Australia

author:US stockS -

Introduction

The US stock market has always been a significant influence on global financial markets, and Australia is no exception. As one of the world's largest economies, the US stock market's movements can have a profound impact on the Australian market. In this article, we will explore the relationship between the US stock market and Australia, discussing the factors that drive this connection and the potential risks and opportunities it presents.

Understanding the Connection

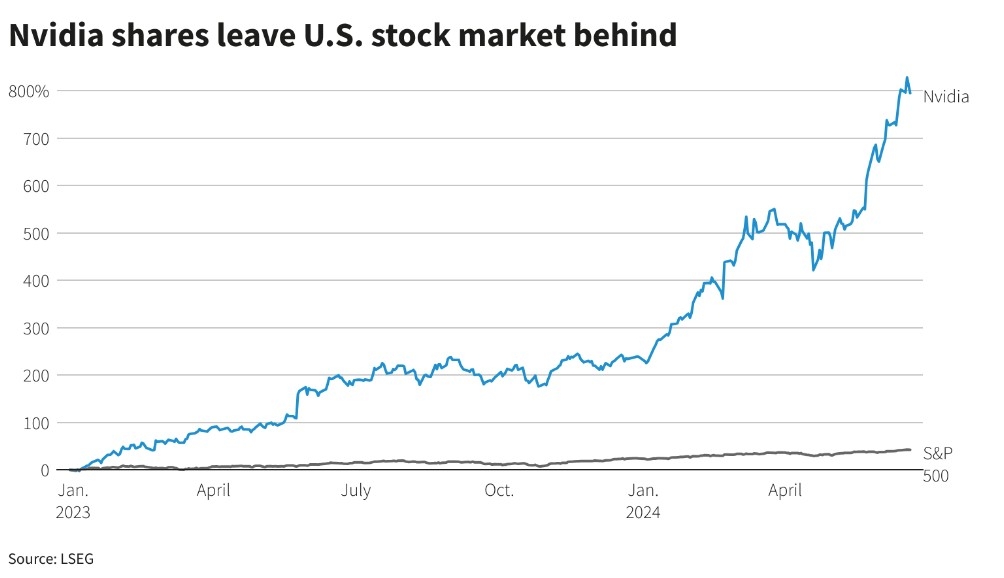

The US stock market, particularly the S&P 500, is often considered a bellwether for the global economy. Its performance can indicate the overall health of the US economy and, by extension, the global economy. Australia, being a major trading partner with the US, is highly susceptible to these economic indicators.

Factors Influencing the Connection

Several factors contribute to the relationship between the US stock market and Australia:

- Trade Relations: Australia and the US have a strong trade relationship, with the US being one of Australia's largest trading partners. Any changes in the US stock market can impact Australian businesses, especially those with significant exposure to the US market.

- Currency Fluctuations: The Australian dollar often tracks the US dollar, so fluctuations in the US stock market can influence the value of the Australian dollar. This, in turn, can affect the profitability of Australian companies with international operations.

- Investor Sentiment: Australian investors often look to the US stock market for investment opportunities. When the US market performs well, Australian investors may be more optimistic about their own market, leading to increased investment and potentially higher stock prices.

Risks and Opportunities

While the connection between the US stock market and Australia presents opportunities, it also comes with risks:

- Volatility: The US stock market can be highly volatile, and this volatility can spill over into the Australian market. This can create uncertainty and potential losses for Australian investors.

- Economic Shocks: Economic shocks in the US can have a ripple effect on the Australian economy, impacting employment, consumer spending, and corporate profits.

- Opportunities for Growth: Conversely, a strong US stock market can provide opportunities for Australian investors to invest in high-performing US companies and benefit from their growth.

Case Studies

To illustrate the impact of the US stock market on Australia, let's look at a few case studies:

- 2008 Financial Crisis: The 2008 financial crisis originated in the US, leading to a significant downturn in the US stock market. This had a profound impact on the Australian market, with the S&P/ASX 200 falling by over 50% in a matter of months.

- 2020 COVID-19 Pandemic: The COVID-19 pandemic initially caused a sharp decline in the US stock market, which in turn affected the Australian market. However, as the US economy began to recover, the Australian market followed suit, with the S&P/ASX 200 eventually recovering its losses.

Conclusion

The relationship between the US stock market and Australia is complex, with both risks and opportunities. Understanding this connection can help investors make informed decisions and navigate the global financial landscape. By staying informed and prepared, investors can capitalize on the potential benefits while mitigating the risks associated with this connection.

new york stock exchange