Regions Bank US Stocks: A Comprehensive Guide

author:US stockS -

In today's dynamic financial landscape, keeping a close eye on the stock market is crucial for investors looking to diversify their portfolios. Among the numerous financial institutions in the United States, Regions Bank has emerged as a notable player. This article delves into the intricacies of Regions Bank's stock performance and its implications for investors.

Understanding Regions Bank

Regions Bank is a full-service bank that offers a range of financial products and services, including retail banking, commercial banking, and wealth management. The bank has a strong presence in the southeastern United States, with a significant number of branches and ATMs across the region. Its diverse offerings and robust performance have made it a popular investment choice for many.

Historical Stock Performance

When analyzing Regions Bank's stock performance, it's essential to look at both the short-term and long-term trends. Over the past few years, the stock has shown impressive growth, with consistent increases in both revenue and earnings. This upward trend can be attributed to several factors, including the bank's strategic expansion, increased loan demand, and improved efficiency.

Factors Influencing Stock Performance

Several factors influence Regions Bank's stock performance, and understanding these can help investors make informed decisions. Here are some key factors to consider:

- Economic Conditions: The overall economic environment plays a significant role in Regions Bank's stock performance. During periods of economic growth, the bank tends to see increased demand for loans and improved profitability.

- Interest Rates: Changes in interest rates can directly impact the bank's earnings. Higher interest rates can lead to increased net interest margins, while lower rates can have the opposite effect.

- Regulatory Environment: Bank regulations can significantly affect Regions Bank's operations and profitability. Changes in regulations can either create new opportunities or impose additional costs on the bank.

Case Studies

To illustrate the impact of these factors on Regions Bank's stock performance, let's consider a couple of case studies:

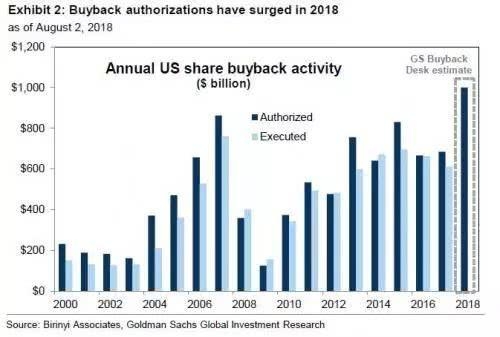

- Economic Growth: During the economic upswing in 2018, Regions Bank's stock experienced substantial growth. This can be attributed to increased loan demand and higher net interest margins, driven by the improving economic conditions.

- Interest Rate Changes: In 2019, when the Federal Reserve raised interest rates, Regions Bank's stock initially faced downward pressure. However, the bank was able to mitigate the impact by improving its net interest margin, leading to a recovery in stock prices.

Conclusion

Regions Bank's stock performance has been impressive over the years, driven by a combination of economic factors, strategic initiatives, and efficient operations. As investors continue to seek opportunities in the financial sector, Regions Bank remains a compelling investment choice. However, it's essential to stay informed about the factors influencing the stock's performance to make informed decisions.

new york stock exchange