Should Canadians Invest in US Stocks? A Comprehensive Guide

author:US stockS -

Are you a Canadian investor considering expanding your portfolio to include US stocks? The idea of investing in US stocks might be appealing due to the strong market performance and diverse range of companies available. However, before making a decision, it's crucial to understand the risks and benefits. In this article, we'll explore the factors to consider when deciding whether Canadians should invest in US stocks.

Understanding the US Stock Market

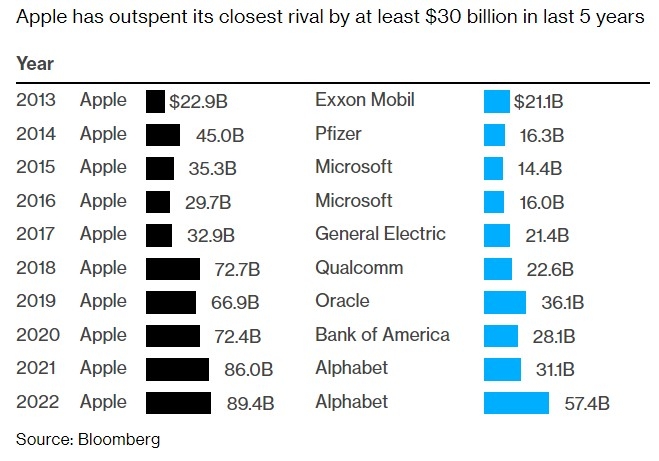

The US stock market is one of the largest and most liquid in the world. It's home to some of the most well-known and successful companies, including Apple, Microsoft, and Amazon. Investing in US stocks can offer several advantages:

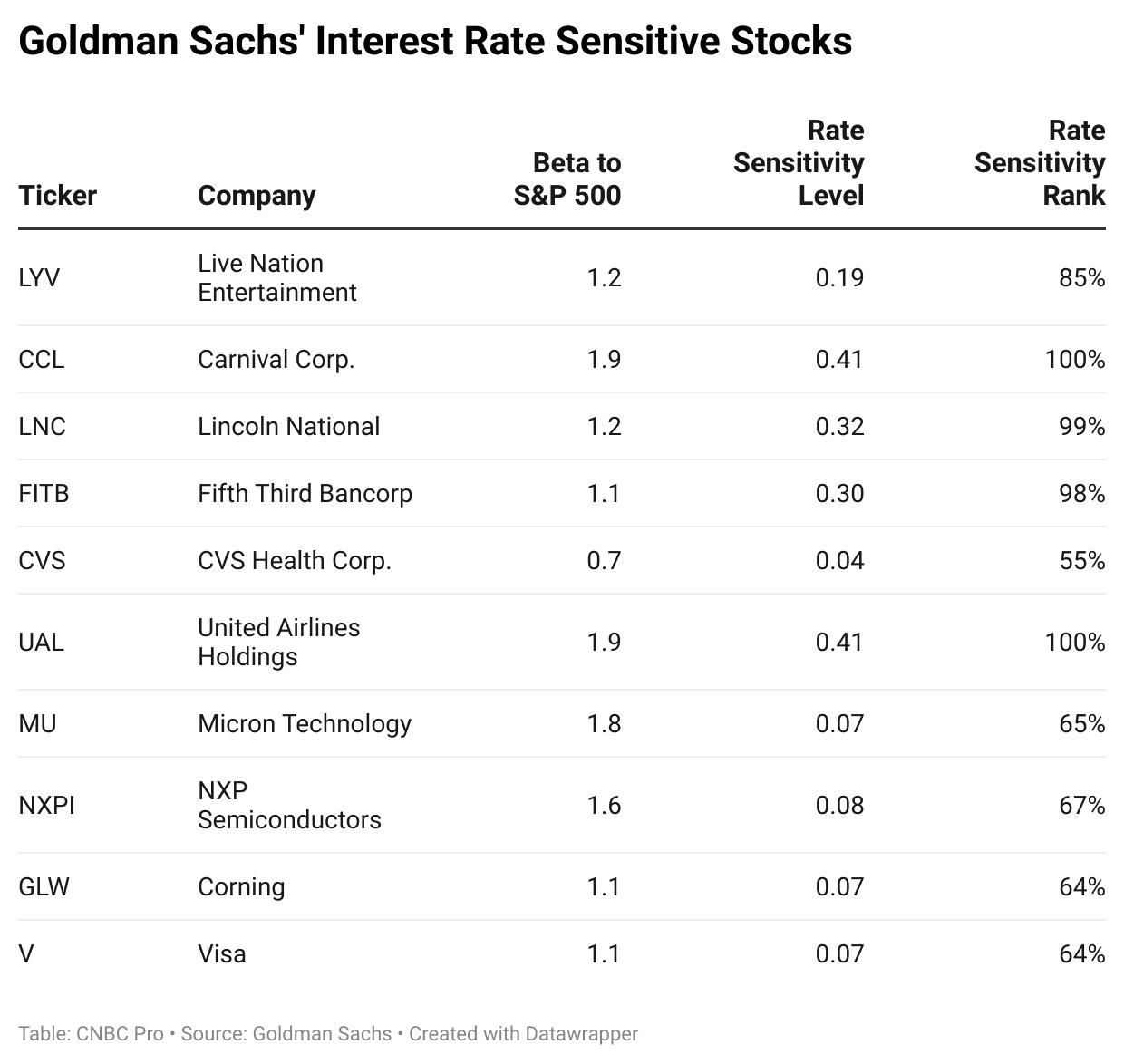

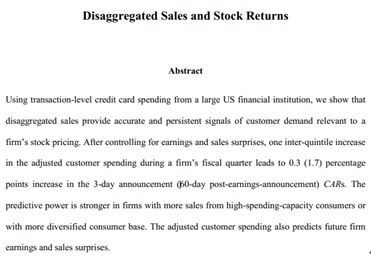

- Diversification: The US stock market includes companies from various industries and sectors, which can help spread out your risk.

- Potential for High Returns: Historically, the US stock market has provided higher returns than other markets.

- Access to Global Companies: Investing in US stocks allows you to gain exposure to some of the world's largest and most influential companies.

Risks to Consider

While investing in US stocks can be beneficial, it's essential to be aware of the potential risks:

- Currency Fluctuations: The Canadian dollar and the US dollar fluctuate in value, which can affect the returns on your investments.

- Tax Implications: There are tax considerations when investing in US stocks, including capital gains tax and withholding taxes.

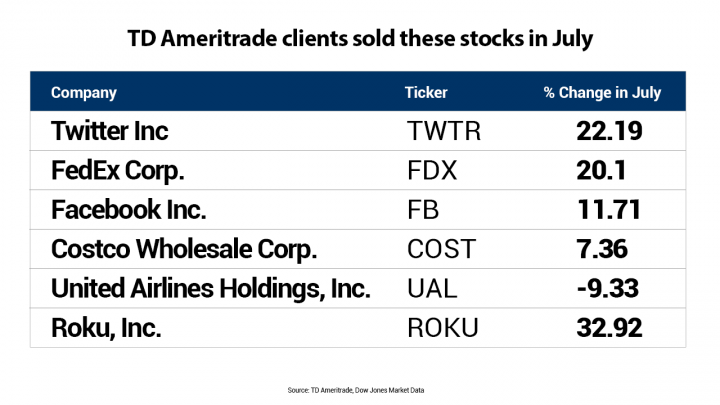

- Political and Economic Risks: The US market is subject to political and economic risks, such as trade disputes and changes in regulations.

Factors to Consider Before Investing

Before investing in US stocks, consider the following factors:

- Your Investment Goals: Are you looking for long-term growth or short-term income?

- Your Risk Tolerance: How comfortable are you with the potential for losses?

- Your Financial Situation: Ensure you have a solid financial foundation before investing in foreign markets.

Case Studies

Let's take a look at two case studies to illustrate the potential benefits and risks of investing in US stocks:

- Long-Term Growth: A Canadian investor invested

10,000 in Apple stock in 2010. By 2020, their investment was worth approximately 200,000, demonstrating the potential for high returns in the US stock market. - Short-Term Losses: Another Canadian investor invested

10,000 in a technology ETF in 2018. By the end of 2019, their investment was worth 8,000, highlighting the potential for short-term losses.

Conclusion

Investing in US stocks can be a valuable addition to your investment portfolio, but it's essential to carefully consider the risks and benefits. By understanding the US stock market, evaluating your investment goals, and being aware of the potential risks, you can make an informed decision about whether to invest in US stocks. Remember, it's always a good idea to consult with a financial advisor before making any investment decisions.

new york stock exchange