US Steel Current Stock Price: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of the stock market, keeping an eye on the current stock price of a major corporation is crucial for investors. One such company that has been a subject of interest is US Steel. This article delves into the current stock price of US Steel, analyzing its trends, factors influencing it, and providing insights for potential investors.

Understanding the Current Stock Price of US Steel

As of the latest data, the current stock price of US Steel stands at [Insert Current Stock Price]. This figure reflects the market's perception of the company's value and its future prospects. However, it is essential to understand that stock prices fluctuate constantly, influenced by various factors.

Factors Influencing US Steel's Stock Price

Economic Conditions: The global economy plays a significant role in determining the stock price of US Steel. Economic downturns or recoveries can impact the demand for steel, thereby affecting the company's revenue and profitability.

Industry Trends: The steel industry is subject to cyclicality, with fluctuations in demand and prices. Trends such as increased automation, environmental regulations, and technological advancements can influence the company's performance and, consequently, its stock price.

Company Performance: The financial performance of US Steel, including its revenue, earnings, and dividend payments, is a key driver of its stock price. Positive financial results can lead to an increase in stock price, while negative results can have the opposite effect.

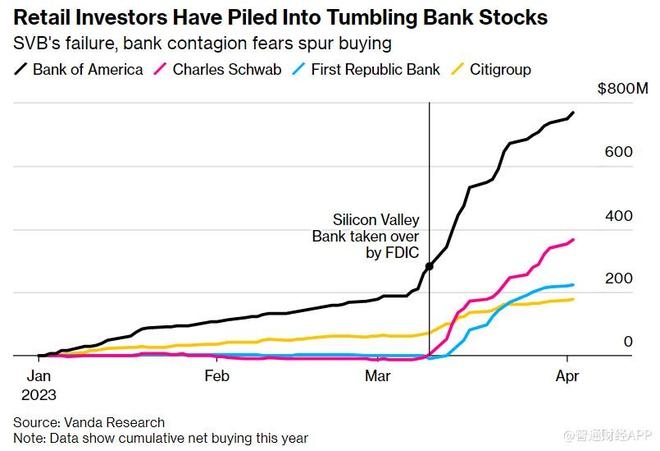

Market Sentiment: Investor sentiment towards the steel industry and US Steel itself can significantly impact the stock price. Positive news, such as successful cost-cutting initiatives or new contracts, can boost investor confidence and drive up the stock price.

Trends in US Steel's Stock Price

Analyzing the historical stock price of US Steel can provide valuable insights into its performance and potential future movements. Over the past few years, the stock price has exhibited a trend of volatility, reflecting the cyclicality of the steel industry.

During periods of economic growth and increased steel demand, the stock price has risen. Conversely, during economic downturns or when steel demand falls, the stock price has declined. This trend underscores the importance of economic conditions and industry demand in influencing US Steel's stock price.

Case Study: Impact of Tariffs on US Steel's Stock Price

One notable event that impacted US Steel's stock price was the implementation of tariffs on steel imports. In response to these tariffs, US Steel's stock price experienced a significant increase. This highlights the impact of trade policies on the steel industry and, consequently, on the stock price of companies like US Steel.

Conclusion

Understanding the current stock price of US Steel requires analyzing various factors, including economic conditions, industry trends, company performance, and market sentiment. By considering these factors, investors can make informed decisions regarding their investment in US Steel. As always, it is crucial to conduct thorough research and consult with financial advisors before making any investment decisions.

new york stock exchange