LG Chem US Stock Market: A Comprehensive Analysis

author:US stockS -

In the dynamic world of the stock market, investors are always on the lookout for promising opportunities. One such company that has caught the attention of many is LG Chem, a South Korean multinational chemical company with a significant presence in the United States. This article delves into the LG Chem US stock market, providing an in-depth analysis of its performance, growth potential, and factors influencing its stock prices.

Understanding LG Chem US

LG Chem, established in 1947, is a leading manufacturer of petrochemicals, plastics, and advanced materials. The company has expanded its operations globally, including the United States, where it has been a significant player in the chemical industry. LG Chem US operates various facilities across the country, focusing on the production of chemicals, batteries, and other advanced materials.

Performance and Growth

In recent years, LG Chem US has demonstrated impressive performance, contributing significantly to the company's global success. The company's revenue has been on an upward trajectory, driven by its diverse product portfolio and strategic investments. LG Chem US has been a key driver of the company's growth, accounting for a substantial portion of its overall revenue.

Stock Market Performance

The stock market performance of LG Chem US has been a topic of interest among investors. The company's stock has experienced fluctuations, reflecting the broader market trends and the company's own performance. Over the past few years, the stock has shown resilience, with several instances of significant growth.

Factors Influencing Stock Prices

Several factors influence the stock prices of LG Chem US. These include:

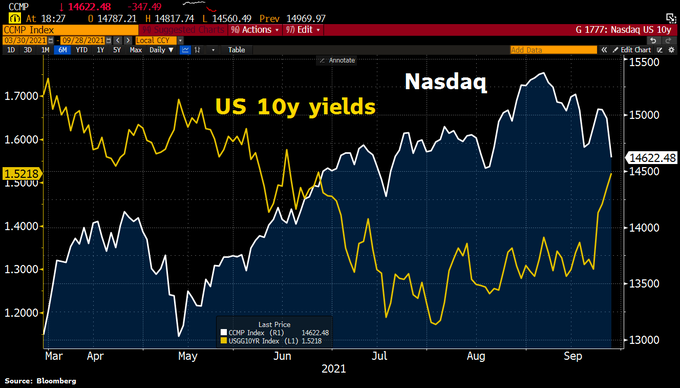

- Economic Conditions: Economic factors, such as inflation, interest rates, and currency fluctuations, can significantly impact the company's performance and, subsequently, its stock prices.

- Industry Trends: The chemical industry is subject to various trends, including technological advancements, regulatory changes, and consumer preferences. These trends can influence the company's growth prospects and, in turn, its stock prices.

- Company Performance: The company's financial performance, including revenue, profit margins, and growth prospects, plays a crucial role in determining its stock prices.

Case Studies

To better understand the performance of LG Chem US, let's consider a few case studies:

- 2019: LG Chem US reported a strong financial performance, with revenue increasing by 15% compared to the previous year. The company's stock price also experienced a significant surge, reflecting its strong performance.

- 2020: The COVID-19 pandemic had a mixed impact on LG Chem US. While the company faced challenges due to supply chain disruptions, it also benefited from increased demand for certain products. The stock price remained relatively stable during this period.

- 2021: LG Chem US continued to demonstrate resilience, with revenue growing by 10%. The company's stock price experienced a modest increase, reflecting its steady performance.

Conclusion

LG Chem US has established itself as a significant player in the chemical industry, with a promising future in the stock market. The company's impressive performance, strategic investments, and resilient stock market performance make it an attractive investment opportunity for investors looking to diversify their portfolios. By understanding the factors influencing the stock prices and keeping a close eye on the company's performance, investors can make informed decisions about their investments in LG Chem US.

new york stock exchange