How Can US Stocks Diversify a Portfolio?

author:US stockS -

Investing in the stock market can be a powerful tool for building wealth over time. However, it's crucial to understand how to effectively diversify your portfolio to mitigate risk and maximize returns. One of the most popular ways to diversify is by investing in US stocks. This article will explore how US stocks can diversify a portfolio and provide some valuable insights to help you make informed investment decisions.

Understanding Portfolio Diversification

Diversification is the process of spreading your investments across various asset classes, industries, and geographical regions to reduce the risk of loss. By diversifying, you can protect your portfolio from the volatility of any single stock or sector.

Why Invest in US Stocks?

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Here are some reasons why investing in US stocks can be beneficial:

- Strong Economic Foundation: The US economy is one of the most robust in the world, with a diverse range of industries and a strong consumer base.

- Innovative Companies: The US is home to many of the world's most innovative and successful companies, such as Apple, Google, and Microsoft.

- Market Liquidity: The US stock market offers high liquidity, making it easy to buy and sell stocks.

- Diverse Sectors: The US stock market includes a wide range of sectors, such as technology, healthcare, finance, and consumer goods.

How US Stocks Can Diversify a Portfolio

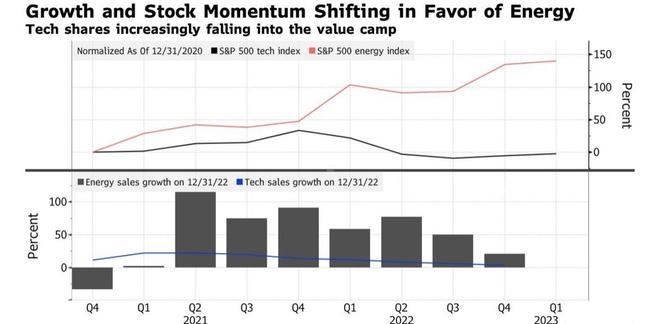

- Sector Diversification: Investing in US stocks allows you to gain exposure to various sectors, such as technology, healthcare, and finance. This can help balance out the performance of your portfolio and reduce the risk of loss in any single sector.

- Geographical Diversification: By investing in US stocks, you can gain exposure to the global economy, as many US companies generate a significant portion of their revenue from international markets.

- Company Size Diversification: The US stock market offers a wide range of companies, from small-cap to large-cap. This allows you to diversify your portfolio based on the size of the companies you invest in, which can help reduce risk.

- Investment Style Diversification: The US stock market includes a variety of investment styles, such as growth, value, and income. This allows you to tailor your portfolio to your investment goals and risk tolerance.

Case Studies

- Technology Sector: Companies like Apple and Microsoft have delivered strong returns over the years, making them valuable additions to a diversified portfolio.

- Healthcare Sector: Companies like Johnson & Johnson and Pfizer have been reliable performers, offering stability and growth potential.

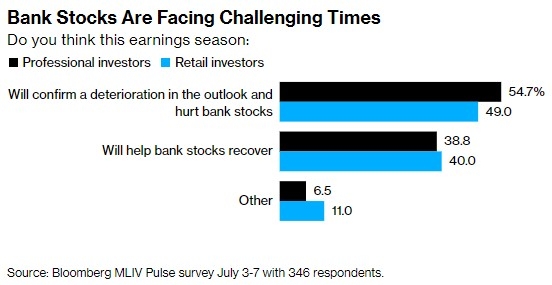

- Financial Sector: Companies like JPMorgan Chase and Wells Fargo have weathered economic downturns and continue to provide attractive returns.

Conclusion

Investing in US stocks can be an effective way to diversify your portfolio and reduce risk. By understanding the benefits of diversification and exploring various sectors and investment styles, you can create a well-rounded portfolio that aligns with your investment goals and risk tolerance. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

new york stock exchange