How Much of the US Stock Is Owned by China?

author:US stockS -

Understanding the Investment Dynamics

The United States and China have long been at the forefront of the global economic stage, with significant investments flowing back and forth between the two nations. One of the most debated topics surrounding this dynamic is the extent to which China owns US stocks. This article delves into this question, providing a comprehensive overview of the current state of affairs.

The Chinese Investment in US Stocks

It's important to note that China's investment in US stocks is a multifaceted issue, encompassing both direct and indirect investments. According to recent reports, China holds a significant stake in the US stock market. However, the exact figure can be challenging to pinpoint due to the complex nature of cross-border investments.

Direct Investments

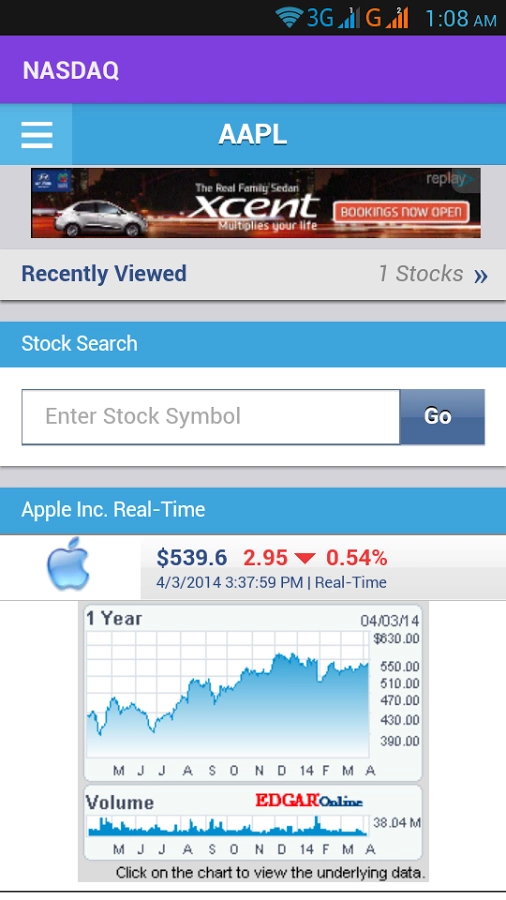

One of the primary ways China invests in the US stock market is through direct purchases of shares. This includes both institutional investors and individual investors. Companies like Alibaba, Baidu, and Tencent have all made significant investments in US stocks, further solidifying China's presence in the market.

Indirect Investments

In addition to direct purchases, China also invests indirectly through various channels. This includes investing in mutual funds, exchange-traded funds (ETFs), and private equity funds that hold US stocks. These indirect investments can be more challenging to track, making it difficult to obtain an exact figure.

The Impact of Trade Tensions

The relationship between the United States and China has been strained in recent years, with trade tensions playing a significant role. This has led to increased scrutiny of Chinese investments in the US stock market. While some argue that these investments are a sign of economic cooperation, others are concerned about potential national security risks.

Case Study: Alibaba's US Stock Investment

One of the most prominent examples of Chinese investment in the US stock market is Alibaba. In 2014, Alibaba went public on the New York Stock Exchange, raising $21.8 billion in the process. This marked the largest IPO in US history at the time. Since then, Alibaba has continued to expand its operations in the US, further solidifying China's presence in the market.

The Role of the US Regulatory Agencies

The US regulatory agencies, such as the Securities and Exchange Commission (SEC), play a crucial role in overseeing foreign investments in the US stock market. These agencies have been increasingly vigilant in monitoring Chinese investments, particularly in light of national security concerns.

Conclusion

The extent to which China owns US stocks is a complex and multifaceted issue. While the exact figure is challenging to determine, it's clear that China has a significant presence in the US stock market. As the global economic landscape continues to evolve, it will be interesting to see how these investments continue to shape the relationship between the United States and China.

new york stock exchange