Title: Canadian Buying US Stocks: A Comprehensive Guide

author:US stockS -

Introduction: Investment opportunities across borders have always been a topic of interest for investors. With the increasing globalization of the stock market, Canadian investors are increasingly looking towards the United States for investment opportunities. In this article, we will explore the reasons behind this trend and provide a comprehensive guide on how Canadian investors can buy US stocks.

Understanding the Trend:

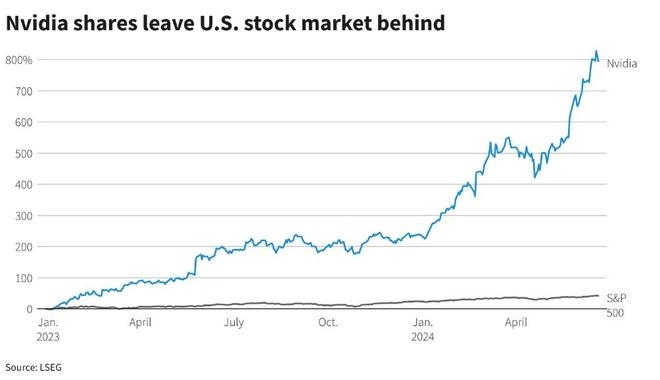

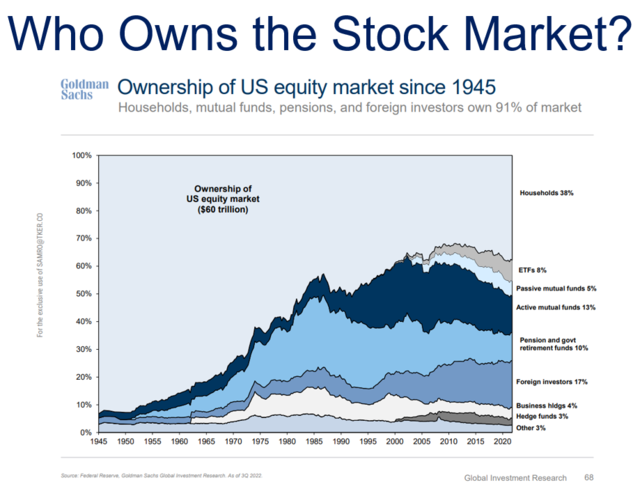

The trend of Canadian investors buying US stocks can be attributed to several factors. Firstly, the US stock market is one of the largest and most liquid in the world, offering a wide range of investment options. Secondly, the US dollar is considered a stable currency, which adds to the attractiveness of US stocks for Canadian investors. Lastly, the technological advancements and strong economic growth in the US have made it an attractive destination for investors.

How to Buy US Stocks:

1. Open a Brokerage Account: The first step for Canadian investors looking to buy US stocks is to open a brokerage account. There are several online brokers that offer access to the US stock market, such as TD Ameritrade, E*TRADE, and Charles Schwab. It's important to choose a broker that offers competitive fees, reliable customer service, and access to a wide range of investment options.

2. Exchange Rates: When buying US stocks, Canadian investors need to consider the exchange rate. The value of the Canadian dollar compared to the US dollar will affect the cost of purchasing US stocks. It's important to stay updated with the exchange rate and consider its impact on your investment returns.

3. Research and Due Diligence: Before investing in US stocks, it's crucial to conduct thorough research and due diligence. This includes analyzing the financial statements, understanding the company's business model, and assessing its competitive position in the market. Tools such as financial ratios, industry analysis, and news updates can be helpful in making informed investment decisions.

4. Diversification: Investing in a diverse portfolio is essential to mitigate risk. Canadian investors can achieve diversification by investing in different sectors, industries, and geographical regions. This can help to balance out the risks associated with investing in a single country's stock market.

5. Tax Considerations: When investing in US stocks, Canadian investors need to be aware of the tax implications. The Canada-US Tax Treaty provides certain benefits to Canadian investors, such as the exclusion of certain dividends from taxation in Canada. However, it's important to consult with a tax professional to understand the specific tax obligations.

Case Study:

Let's consider the case of John, a Canadian investor who is interested in investing in US stocks. After conducting thorough research, John decides to invest in Apple Inc. (AAPL). He opens a brokerage account with TD Ameritrade and buys 100 shares of AAPL at

Conclusion: Investing in US stocks can be a lucrative opportunity for Canadian investors. By understanding the process, conducting thorough research, and considering tax implications, Canadian investors can make informed investment decisions. As the global stock market continues to evolve, the trend of Canadian investors buying US stocks is likely to persist.

new york stock exchange