Current Total Market Capitalization of US Stock Market

author:US stockS -

The current total market capitalization of the US stock market is a crucial metric for investors, analysts, and financial experts. It represents the total value of all publicly-traded companies in the United States. This figure fluctuates constantly due to market dynamics, economic conditions, and company performance. In this article, we delve into the current state of the US stock market, its significance, and what it means for investors.

Understanding Market Capitalization

Market capitalization, often referred to as "market cap," is calculated by multiplying the current market price of a stock by the total number of shares outstanding. It is a measure of the size and value of a company. Companies are typically categorized into three market cap ranges: small-cap, mid-cap, and large-cap.

- Small-cap companies have a market cap of less than $2 billion.

- Mid-cap companies have a market cap between

2 billion and 10 billion. - Large-cap companies have a market cap of over $10 billion.

Current Total Market Capitalization

As of the latest data available, the total market capitalization of the US stock market stands at approximately $40 trillion. This figure is derived from the market cap of all publicly-traded companies in the United States. It is a significant increase from the pre-pandemic era and reflects the strong performance of the stock market.

Significance of Market Capitalization

Understanding the current total market capitalization of the US stock market is essential for several reasons:

- Investment Opportunities: The market cap provides investors with an overview of potential investment opportunities. By analyzing the market cap of different sectors and companies, investors can identify sectors with high growth potential and invest accordingly.

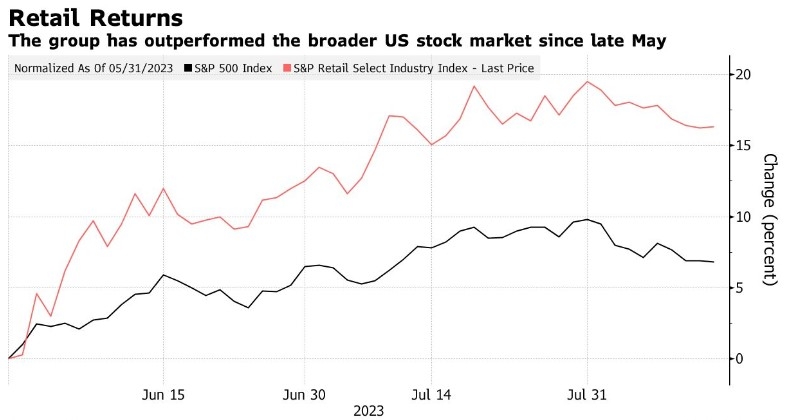

- Market Trends: The market cap reflects market trends and investor sentiment. A rising market cap indicates optimism and confidence in the market, while a falling market cap may signal concerns and uncertainty.

- Economic Indicators: The market cap serves as an economic indicator, providing insights into the overall health and performance of the US economy.

Sector Analysis

The US stock market is divided into various sectors, each with its unique characteristics and performance drivers. The following sectors contribute significantly to the current total market capitalization:

- Technology: The technology sector, led by giants like Apple, Microsoft, and Amazon, is a major contributor to the market cap. It has seen significant growth in recent years, driven by increasing demand for technology products and services.

- Healthcare: The healthcare sector, including pharmaceutical companies, biotech firms, and medical device manufacturers, has also seen substantial growth, driven by advancements in medical technology and increasing demand for healthcare services.

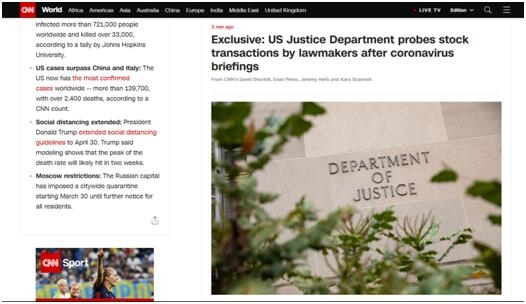

- Financials: The financial sector, which includes banks, insurance companies, and investment firms, plays a vital role in the stock market. It contributes significantly to the total market cap due to the size and influence of major financial institutions.

Conclusion

The current total market capitalization of the US stock market is a critical metric for understanding the overall health and performance of the market. By analyzing this figure, investors can identify potential opportunities and make informed decisions. As the market continues to evolve, keeping an eye on the market cap will be crucial for success.

new york stock exchange