3 Major US Stock Indexes: A Comprehensive Guide

author:US stockS -

In the vast world of the stock market, three major indexes stand out as key indicators of market trends and economic health. These indexes are the Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite Index. Understanding the characteristics and significance of these indexes is crucial for investors and traders alike. In this article, we'll delve into the details of each index, their history, and how they impact the broader market.

The Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average, often simply referred to as the Dow, is one of the oldest and most widely followed stock market indexes in the United States. It was first published by Charles Dow in 1896 and initially included 12 stocks. Over time, the index has evolved to include 30 large, publicly traded companies across various sectors.

The Dow is a price-weighted index, meaning that the stock with the highest share price has the most significant impact on the index's value. This index is particularly popular among investors as a benchmark for the overall health of the stock market. When the Dow rises, it suggests that the market is performing well, and vice versa.

The S&P 500

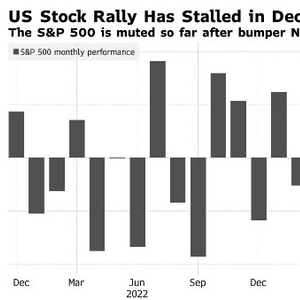

The S&P 500 is another major stock market index, representing a broad range of the U.S. economy. It includes 500 large-cap companies from various sectors, with a focus on market capitalization. The index was first published by Standard & Poor's in 1957 and is widely considered one of the best measures of the stock market's performance.

The S&P 500 is a market-cap-weighted index, meaning that the index's value is influenced by the market capitalization of the companies within it. This index is particularly popular among investors because it represents a significant portion of the U.S. stock market. It's often used as a benchmark for mutual funds, exchange-traded funds (ETFs), and other investment vehicles.

The NASDAQ Composite Index

The NASDAQ Composite Index is the largest U.S. stock market index based on market capitalization. It includes more than 3,200 companies, with a focus on technology, biotechnology, and other growth-oriented sectors. The index was first published in 1971 and has since become a leading indicator of the tech industry's performance.

The NASDAQ Composite is a market-cap-weighted index, similar to the S&P 500. However, it tends to be more volatile due to its higher concentration of technology and growth-oriented companies. This index is particularly popular among investors looking for exposure to the tech industry and other emerging sectors.

Impact on the Broader Market

The three major U.S. stock indexes have a significant impact on the broader market and investor sentiment. When one or more of these indexes experience a significant move, it often triggers a ripple effect across the entire market. For example, a rise in the Dow or the S&P 500 can boost investor confidence and lead to increased market participation, while a decline can have the opposite effect.

Moreover, these indexes serve as a valuable tool for investors to assess the overall health of the market and identify potential opportunities. By analyzing the performance of these indexes over time, investors can gain insights into market trends and make informed investment decisions.

Case Study: The Dot-Com Bubble

One notable example of how these indexes can impact the broader market is the dot-com bubble of the late 1990s. During this period, the NASDAQ Composite Index experienced an explosive rise, driven by rapid growth in the tech sector. However, as the bubble burst, the index plummeted, dragging down the broader market and causing significant losses for investors.

This case study highlights the importance of understanding the dynamics of these major indexes and how they can influence market movements.

In conclusion, the Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite Index are three essential tools for investors and traders looking to navigate the complex world of the stock market. By understanding the characteristics and significance of these indexes, investors can make more informed decisions and better manage their portfolios.

new york stock exchange