Can You Invest TFSA in US Stocks? A Comprehensive Guide

author:US stockS -

Are you considering investing your Tax-Free Savings Account (TFSA) in US stocks? It's a question many Canadian investors ponder. While the idea might seem appealing, there are several factors to consider before diving in. In this article, we'll explore whether it's possible to invest your TFSA in US stocks and what you need to know to make an informed decision.

Understanding Your TFSA

First, let's clarify what a TFSA is. A TFSA is a registered account in Canada that allows you to save and invest tax-free. Contributions to your TFSA are not tax-deductible, but any earnings, dividends, or capital gains you earn within the account are tax-free. This makes it an attractive option for long-term saving and investing.

Investing in US Stocks Through Your TFSA

The short answer is yes, you can invest your TFSA in US stocks. However, there are a few important considerations to keep in mind:

1. Currency Conversion

One of the main challenges of investing in US stocks through your TFSA is currency conversion. When you purchase US stocks, you'll be converting Canadian dollars to US dollars. This can result in additional fees and potential currency fluctuations. It's important to factor in these costs when evaluating the potential returns of your investment.

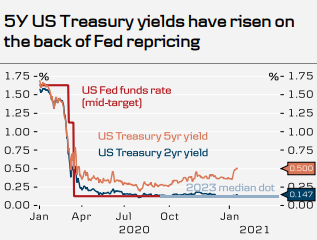

2. Tax Implications

While earnings within your TFSA are tax-free, there are still tax implications to consider when investing in US stocks. If you sell a US stock held within your TFSA, you'll need to pay capital gains tax on the profit. Additionally, if you receive dividends from a US stock, you may be subject to Canadian tax on the foreign income.

3. Brokerage Fees

When investing in US stocks through your TFSA, you'll need to use a Canadian brokerage firm that offers access to US markets. Be aware that these firms may charge higher fees for trading US stocks compared to Canadian stocks. It's important to research and compare brokerage fees to ensure you're getting the best deal.

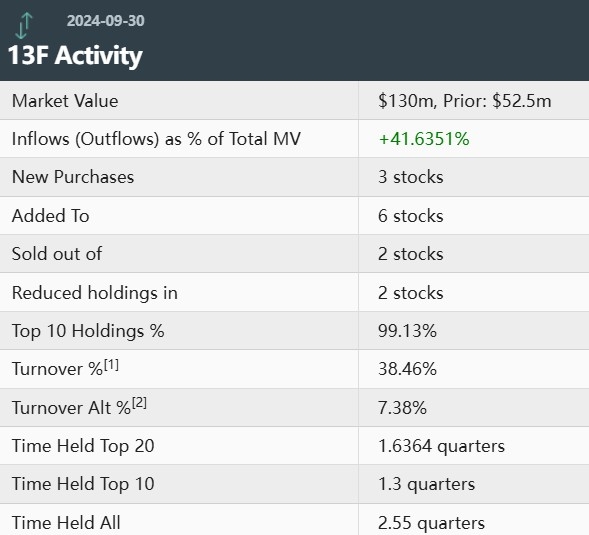

4. Diversification

Investing in US stocks can provide diversification to your TFSA portfolio. However, it's crucial to understand that the US market is different from the Canadian market. Factors such as economic conditions, political events, and currency fluctuations can impact US stocks differently than Canadian stocks.

Case Study: Investing in US Stocks Through a TFSA

Let's consider a hypothetical example. Imagine you have a TFSA with a balance of

Conclusion

Investing your TFSA in US stocks can be a viable option, but it's important to carefully consider the potential risks and benefits. By understanding the currency conversion, tax implications, brokerage fees, and diversification aspects, you can make an informed decision that aligns with your investment goals and risk tolerance.

new york stock exchange