5 US Stocks to Buy Now

author:US stockS -

Are you looking to diversify your investment portfolio with some promising U.S. stocks? With the stock market's constant fluctuations, it's crucial to identify stocks with strong potential for growth. In this article, we'll explore five U.S. stocks that could be a solid addition to your portfolio right now.

1. Apple Inc. (AAPL)

Apple Inc. (AAPL) is a global technology leader with a market capitalization of over $2 trillion. The tech giant has consistently delivered impressive financial results, making it one of the most valuable companies in the world. Apple's iPhone, iPad, and Mac products have a strong market presence, and the company has been expanding its services business, including Apple Music, iCloud, and Apple TV+. With a robust balance sheet and a forward P/E ratio of just 28, Apple Inc. is a stock worth considering.

Case Study: Apple's revenue increased by 18% in Q1 2022, driven by strong demand for its iPhone and services. The company also reported a 35% increase in revenue from services, highlighting the potential of this segment.

2. Microsoft Corporation (MSFT)

Microsoft Corporation (MSFT) is another dominant player in the technology industry, with a market capitalization of over $2 trillion. The company has a diversified portfolio, including cloud computing, gaming, and productivity tools. Microsoft Azure has been a significant revenue driver, and the company's recent acquisition of Nuance Communications further strengthens its position in the healthcare AI market. With a forward P/E ratio of 25 and a strong dividend yield, Microsoft Corporation is a solid investment.

Case Study: Microsoft reported a 19% increase in revenue for Q1 2022, driven by strong growth in Azure and other cloud services. The company's enterprise and cloud division revenue grew by 22% year-over-year.

3. Visa Inc. (V)

Visa Inc. (V) is a leading payment processing company with a market capitalization of over

Case Study: Visa reported a 12% increase in net revenue for Q1 2022, driven by growth in cross-border and digital payments. The company also expanded its presence in emerging markets, which contributed to its overall revenue growth.

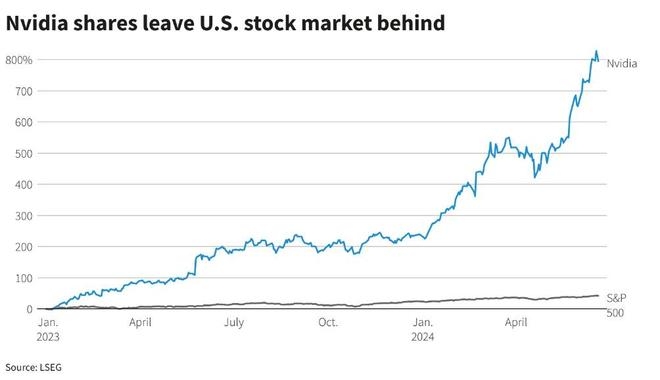

4. NVIDIA Corporation (NVDA)

NVIDIA Corporation (NVDA) is a leading graphics processing unit (GPU) and data center chip manufacturer with a market capitalization of over $600 billion. The company has been a significant beneficiary of the rise in gaming, AI, and data center demand. NVIDIA's GPU products have a strong market presence, and the company has been investing heavily in AI research and development. With a forward P/E ratio of 47 and a robust growth outlook, NVIDIA Corporation is a stock worth considering.

Case Study: NVIDIA reported a 50% increase in revenue for Q1 2022, driven by strong demand for its GPU products. The company also reported significant growth in its data center and AI segments.

5. Amazon.com, Inc. (AMZN)

Amazon.com, Inc. (AMZN) is an e-commerce and cloud computing giant with a market capitalization of over $1.5 trillion. The company has been a significant driver of the e-commerce industry and has expanded its offerings to include cloud computing, digital streaming, and grocery delivery. With a forward P/E ratio of 100 and a robust growth outlook, Amazon.com, Inc. is a stock worth considering.

Case Study: Amazon reported a 27% increase in net revenue for Q1 2022, driven by strong growth in e-commerce and cloud computing. The company also expanded its physical store presence, which contributed to its overall revenue growth.

These five U.S. stocks have strong potential for growth and could be a valuable addition to your investment portfolio. However, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

new york stock exchange