Best Stocks to Play If China-US Deal materializes

author:US stockS -

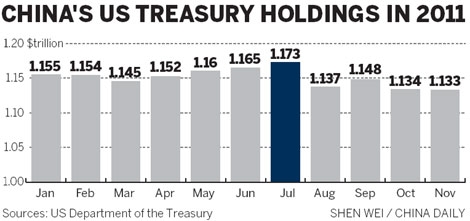

In the wake of recent trade tensions between the United States and China, investors are eagerly eyeing any potential breakthroughs that could lead to a China-US deal. Such an agreement could have a significant impact on various sectors of the economy, presenting a unique opportunity for investors to capitalize on the potential winners. In this article, we will explore some of the best stocks to play if a China-US deal materializes.

Technology Sector: Apple (AAPL) and Micron Technology (MU)

The technology sector is one of the most affected by the China-US trade war, with companies like Apple and Micron Technology facing increased tariffs and supply chain disruptions. However, a China-US deal could lead to reduced trade barriers, improving the supply chain and boosting profits for these companies.

Apple (AAPL): The tech giant has faced significant challenges due to the trade war, but a deal with China could significantly improve its bottom line. Apple's products are highly sought after in China, and a trade agreement could lead to increased sales and lower costs.

Micron Technology (MU): As a leading manufacturer of memory chips, Micron Technology has been hit hard by the trade war. A China-US deal could help the company secure a stable supply chain and reduce production costs, leading to improved profitability.

Automotive Sector: Tesla (TSLA) and Ford (F)

The automotive sector is another industry heavily impacted by the China-US trade war. Companies like Tesla and Ford have faced supply chain disruptions and increased tariffs, which could be mitigated with a China-US deal.

Tesla (TSLA): Tesla's operations in China have been affected by the trade war, with increased tariffs on its imported vehicles. A China-US deal could lead to lower costs and improved sales in the world's largest automotive market.

Ford (F): Ford has been struggling in the Chinese market, but a trade deal could help the company stabilize its operations and increase its market share. The deal could also help Ford secure a stable supply chain for critical components.

Consumer Goods Sector: Procter & Gamble (PG) and Estée Lauder (EL)

The consumer goods sector has also been affected by the trade war, with companies like Procter & Gamble and Estée Lauder facing increased tariffs and supply chain disruptions.

Procter & Gamble (PG): Procter & Gamble's products are widely consumed in China, and a trade deal could lead to increased sales and lower costs for the company.

Estée Lauder (EL): Estée Lauder has faced challenges in the Chinese market due to the trade war, but a deal could help the company stabilize its sales and improve its profitability.

Conclusion

In conclusion, a potential China-US deal presents a unique opportunity for investors to capitalize on the potential winners in various sectors. By focusing on companies like Apple, Micron Technology, Tesla, Ford, Procter & Gamble, and Estée Lauder, investors can position themselves to benefit from any positive developments that may arise from a trade agreement between the two countries.

new york stock exchange