U.S. Stock Futures Fall Ahead of Inflation Data

author:US stockS -

In the financial world, anticipation often precedes the actual event. This is particularly true when it comes to economic data releases that can significantly impact the stock market. One such event is the upcoming release of inflation data, which is currently causing U.S. stock futures to fall. This article delves into the reasons behind this trend and examines the potential implications for investors.

Understanding the Importance of Inflation Data

Inflation is a key indicator of economic health. It measures the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. When inflation is low and stable, it is generally a sign of a healthy economy. However, when inflation rises too quickly, it can lead to higher costs for businesses and consumers, potentially leading to a recession.

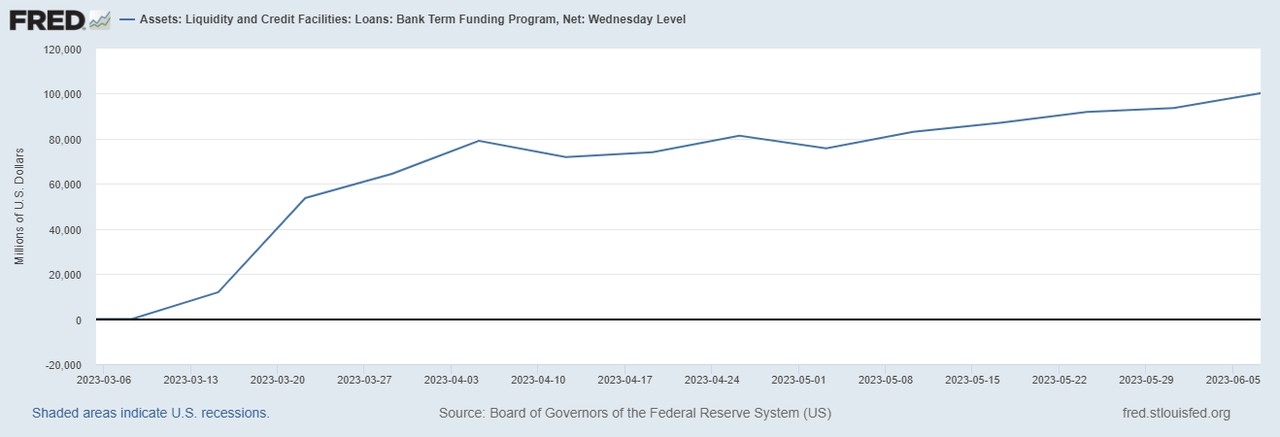

The upcoming inflation data is expected to provide valuable insights into the current state of the economy. If the data shows that inflation is rising at a faster pace than expected, it could lead to concerns about the Federal Reserve's monetary policy. This is because the Fed uses interest rates to control inflation, and a higher inflation rate could prompt the Fed to raise rates more aggressively.

Why Are Stock Futures Falling?

The anticipation of higher inflation and the potential for more aggressive monetary policy from the Fed has led to a decline in U.S. stock futures. This is because higher interest rates can make borrowing more expensive, which can slow down economic growth and reduce corporate profits.

Investment Implications

For investors, the falling stock futures ahead of the inflation data release present both opportunities and risks. Here are a few key considerations:

1. Value Investing Opportunities: Value investors may find opportunities in stocks that have been beaten down by the market's anticipation of higher inflation and interest rates. These stocks may offer attractive valuations and potential for future growth.

2. Risk Management: Investors should be mindful of their exposure to sectors that are particularly sensitive to interest rate changes, such as financials, real estate, and consumer discretionary stocks.

3. Diversification: Diversifying your portfolio across different asset classes and sectors can help mitigate the impact of rising inflation and interest rates.

Case Study: The 1970s Inflationary Period

A historical case study that illustrates the impact of inflation on the stock market is the period in the 1970s when inflation reached double digits. During this time, the stock market experienced significant volatility, with many investors losing money. However, those who were able to navigate the market and invest in companies that were able to pass on higher costs to consumers ultimately came out ahead.

Conclusion

The upcoming release of inflation data is a crucial event for the U.S. stock market. While the current trend of falling stock futures is concerning, it also presents opportunities for investors who are willing to take on risk. By understanding the potential implications of higher inflation and interest rates, investors can make informed decisions and position their portfolios for the future.

dow and nasdaq today