Stock Price US Bancorp: A Comprehensive Analysis

author:US stockS -

In the ever-evolving financial landscape, US Bancorp has emerged as a key player in the banking industry. The stock price of US Bancorp has been a topic of interest for investors and analysts alike. This article delves into a comprehensive analysis of the stock price of US Bancorp, exploring its historical trends, current market dynamics, and future prospects.

Historical Stock Price Trends

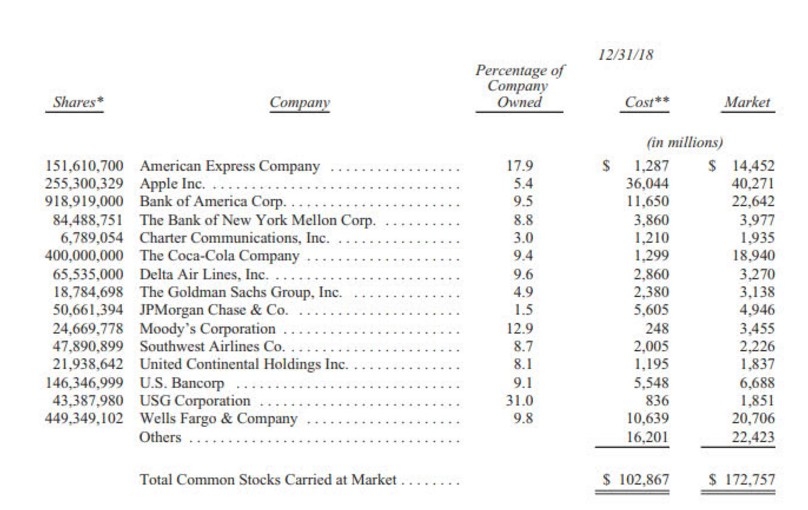

The stock price of US Bancorp has shown steady growth over the years. Historical data reveals that the stock has appreciated significantly since its initial public offering (IPO) in 1988. Over the past decade, the stock has exhibited a strong upward trend, with several periods of volatility.

Current Market Dynamics

The current market dynamics play a crucial role in determining the stock price of US Bancorp. Several factors contribute to the stock's performance in the market:

Economic Factors: The overall economic conditions, including interest rates, inflation, and GDP growth, significantly impact the stock price of US Bancorp. Low interest rates have historically been beneficial for the banking sector, as they allow banks to lend at lower rates and generate higher net interest margins.

Regulatory Environment: The regulatory landscape is another critical factor. Stringent regulations can lead to increased compliance costs for banks, potentially affecting their profitability. Conversely, loosening regulations can boost the stock price.

Competitive Landscape: The competitive environment within the banking industry also influences the stock price. Increased competition from fintech companies and other banks can put pressure on the stock price, while strong market positioning can drive it higher.

Future Prospects

Looking ahead, the future prospects for the stock price of US Bancorp appear promising. Several factors contribute to this optimism:

Strong Financial Performance: US Bancorp has consistently reported strong financial performance, with robust earnings growth and a healthy capital position. This has bolstered investor confidence in the stock.

Diversified Business Model: The bank's diversified business model, which includes retail banking, commercial banking, and wealth management, provides a cushion against economic downturns and market volatility.

Digital Transformation: US Bancorp has been actively embracing digital transformation, investing in technology to enhance customer experience and operational efficiency. This strategic move is expected to drive long-term growth.

Case Studies

To illustrate the impact of market dynamics on the stock price, let's consider a few case studies:

Interest Rate Hike: In 2018, the Federal Reserve raised interest rates multiple times. While this initially caused some concern among investors, the stock price of US Bancorp remained resilient, reflecting the bank's strong financial position and ability to navigate changing interest rate environments.

COVID-19 Pandemic: The COVID-19 pandemic created unprecedented challenges for the financial industry. However, US Bancorp's proactive measures, including providing financial relief to customers and adapting to remote banking, helped mitigate the impact on its stock price.

In conclusion, the stock price of US Bancorp has been influenced by a combination of economic factors, regulatory environment, and competitive landscape. With a strong financial performance, diversified business model, and commitment to digital transformation, the future prospects for the stock appear promising. As investors and analysts continue to monitor the stock price, it is essential to consider these factors in their analysis.

dow and nasdaq today