US Stock Premarket: What You Need to Know

author:US stockS -Premarket(5)Stock(238)What(43)You(23)Need(12)

In the fast-paced world of finance, staying ahead of the curve is crucial for investors. One of the most critical aspects of this is keeping an eye on the US stock premarket. The premarket trading session, often referred to as the "pre-market," is a window of opportunity for investors to trade before the official market open. In this article, we delve into what the US stock premarket is, how it works, and why it matters to investors.

What is the US Stock Premarket?

The US stock premarket refers to the period before the regular trading hours of the stock exchanges, typically from 4:00 AM to 9:30 AM Eastern Time. During this time, traders can buy and sell stocks, options, and other securities. While the premarket is not as active as the regular trading session, it can provide valuable insights into market trends and potential trading opportunities.

How Does the US Stock Premarket Work?

The premarket trading session operates similarly to the regular trading hours, with a few key differences. Here's a breakdown of how it works:

Opening Prices: The premarket session sets the opening prices for stocks that will be traded during the regular trading hours. This can influence the opening bell prices when the market officially opens.

Volume: While the volume during the premarket is generally lower than during regular trading hours, it can still be significant. High trading volumes in the premarket can indicate strong interest in a particular stock, potentially leading to price movements during the regular session.

Market Trends: The premarket provides a glimpse into market trends and investor sentiment. By analyzing the movements of key indices and individual stocks during the premarket, investors can gain insights into market conditions and make informed decisions.

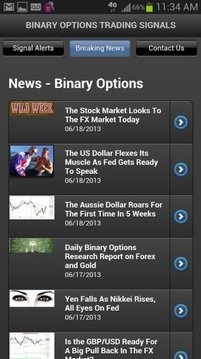

News and Events: The premarket is often influenced by news and events that occur after the regular trading session has ended. This can include earnings reports, economic data, and other significant announcements.

Why Does the US Stock Premarket Matter to Investors?

The US stock premarket is a valuable tool for investors for several reasons:

Early Access: The premarket allows investors to trade before the official market open, giving them a head start on potential opportunities.

Market Insights: By monitoring the premarket, investors can gain insights into market trends and investor sentiment, helping them make more informed decisions.

Risk Management: The premarket can be used to manage risk by taking advantage of early price movements and adjusting positions before the market opens.

News and Events: The premarket is often influenced by news and events that occur after the regular trading session has ended. By staying informed, investors can react quickly to these developments.

Case Study: The Impact of Earnings Reports on the Premarket

One of the most significant influences on the premarket is earnings reports. Let's consider a hypothetical scenario:

Company A is expected to release its earnings report after the regular trading session ends. Investors are closely watching the company's performance, as it has been underperforming recently. During the premarket, there is a surge in trading activity for Company A's stock. Traders are reacting to rumors about the earnings report, and the stock price is moving significantly.

When the regular trading session opens, the market reacts to the actual earnings report, which is better than expected. The stock price surges, and investors who traded during the premarket benefit from the early movement in the stock price.

In conclusion, the US stock premarket is a critical component of the trading day. By understanding how it works and why it matters, investors can gain a competitive edge in the market. Whether you're a seasoned trader or just starting out, staying informed about the premarket can help you make more informed decisions and potentially improve your investment returns.

dow and nasdaq today