Can I Trade US Stocks from Philippines?

author:US stockS -

Are you a Filipino investor looking to expand your investment portfolio to include U.S. stocks? The question, "Can I trade US stocks from Philippines?" is one that many Filipino investors ponder. The good news is that trading U.S. stocks from the Philippines is not only possible but also offers numerous benefits. In this article, we will explore the ins and outs of trading U.S. stocks from the Philippines, including the process, the benefits, and some tips for getting started.

Understanding the Process

Trading U.S. stocks from the Philippines involves a few steps. First, you'll need to open a brokerage account with a reputable online brokerage firm that offers access to U.S. markets. Some popular brokerage firms that cater to Filipino investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Once you have opened an account, you will need to fund it with U.S. dollars. You can do this by transferring funds from your Philippine bank account to your brokerage account. Some brokers may offer the option to fund your account using Philippine pesos, but this is not always available.

Benefits of Trading U.S. Stocks from the Philippines

- Access to a Diverse Market: The U.S. stock market is one of the largest and most diversified in the world. This means that you can invest in a wide range of sectors and industries, from technology to healthcare to consumer goods.

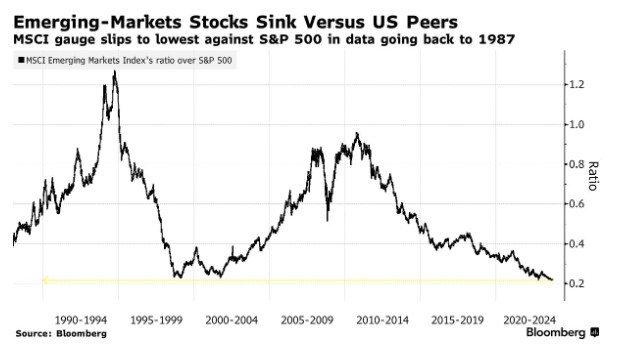

- Potential for Higher Returns: U.S. stocks have historically offered higher returns than stocks in the Philippines. This is due to the strong economic growth, technological advancements, and regulatory environment in the U.S.

- Investment Opportunities: The U.S. market is home to many of the world's largest and most successful companies. Investing in these companies can provide you with exposure to global market trends and opportunities.

- Tax Advantages: Depending on your tax situation, investing in U.S. stocks from the Philippines may offer tax advantages. For example, if you hold your investments for more than a year, you may qualify for long-term capital gains treatment.

Tips for Getting Started

- Research and Choose a Brokerage Firm: Take the time to research different brokerage firms and choose one that best fits your needs. Consider factors such as fees, customer service, and the platform's user-friendliness.

- Understand the Risks: While U.S. stocks offer potential for high returns, they also come with risks. It's important to understand these risks and invest accordingly.

- Start Small: If you're new to trading U.S. stocks, it may be a good idea to start with a small amount of capital. This will allow you to get a feel for the market without risking too much of your investment capital.

- Stay Informed: Keep up with market news and trends to stay informed about the companies you're invested in and the overall market.

Case Study: Investing in U.S. Stocks from the Philippines

Let's say you're a Filipino investor who decides to invest in U.S. stocks. You open an account with TD Ameritrade and decide to invest in Apple Inc. (AAPL). Over the next five years, you continue to invest in U.S. stocks and your portfolio grows significantly. This is a real-life example of how investing in U.S. stocks from the Philippines can be a rewarding experience.

In conclusion, trading U.S. stocks from the Philippines is not only possible but also offers numerous benefits. By following the steps outlined in this article and doing your research, you can successfully trade U.S. stocks from the Philippines and potentially grow your investment portfolio.

dow and nasdaq today