US Stock Exchange After Hours: What You Need to Know

author:US stockS -

In the world of finance, the trading day doesn't end when the bell rings at the stock exchange. The US stock exchange after hours is a crucial component of the trading landscape, offering investors opportunities and risks that extend beyond the standard trading hours. This article delves into the intricacies of after-hours trading, its benefits, risks, and how it impacts the broader market.

Understanding After-Hours Trading

What is After-Hours Trading? After-hours trading refers to the buying and selling of stocks and other securities outside of the regular trading hours, typically from 4:00 p.m. to 9:30 a.m. on Eastern Time. This trading period is divided into two segments: pre-market trading and post-market trading.

Pre-Market Trading Pre-market trading begins at 4:00 a.m. and ends at 9:30 a.m. During this time, investors can place orders to buy or sell stocks, but the orders are not immediately executed. Instead, they are queued and executed once the regular trading day opens.

Post-Market Trading Post-market trading starts at the end of the regular trading day and lasts until 4:00 a.m. Similar to pre-market trading, post-market trading allows investors to place orders, but they are not executed immediately.

Benefits of After-Hours Trading

Extended Trading Hours One of the primary benefits of after-hours trading is the extended trading hours. This allows investors to react to news and market developments that occur after the regular trading day ends, potentially capitalizing on opportunities that may not be available during regular trading hours.

Improved Market Efficiency After-hours trading contributes to improved market efficiency by allowing investors to react quickly to new information. This helps in maintaining the price discovery process and ensuring that stock prices reflect all available information.

Access to More Information After-hours trading provides investors with access to more information than during regular trading hours. This includes earnings reports, corporate announcements, and other news that can impact stock prices.

Risks of After-Hours Trading

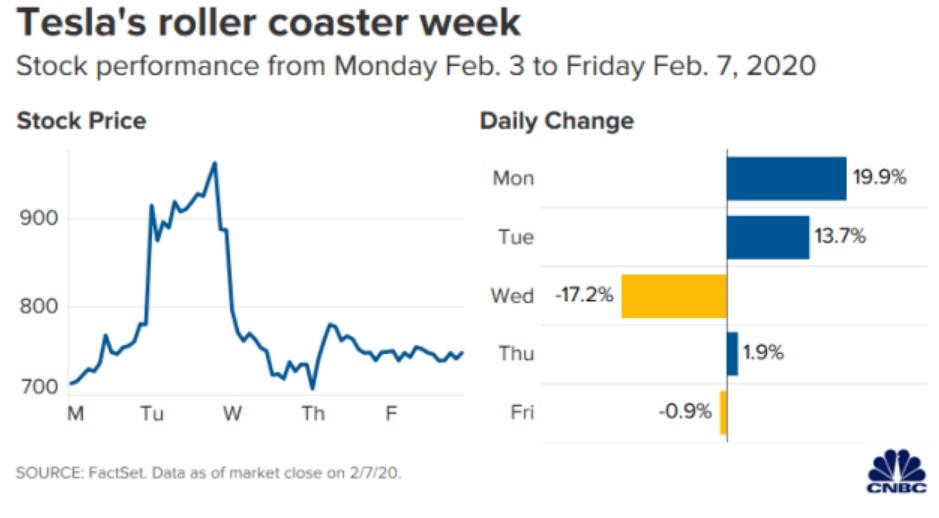

Volatility One of the biggest risks of after-hours trading is increased volatility. Since there are fewer traders during after-hours periods, the market can be more susceptible to rapid price movements based on limited information.

Lack of Liquidity After-hours trading often has lower liquidity compared to regular trading hours. This can make it more challenging to execute trades at desired prices, especially for larger orders.

Potential for Manipulation The lack of regulatory oversight during after-hours trading can lead to potential market manipulation. This is particularly concerning for retail investors who may not have the same resources as institutional traders.

Case Study: Facebook's IPO

One notable case of after-hours trading is the Facebook IPO in 2012. The IPO was initially priced at

Conclusion

The US stock exchange after hours offers investors unique opportunities and risks. While it provides access to more information and extended trading hours, it also comes with increased volatility and potential manipulation. Understanding the intricacies of after-hours trading is essential for investors looking to navigate the complex world of finance.

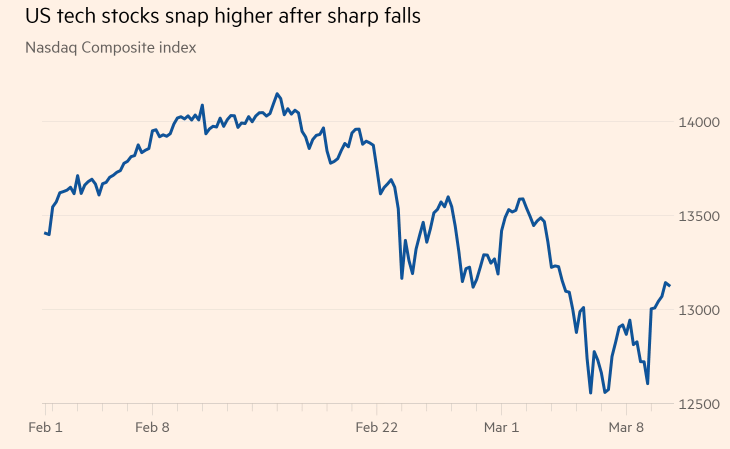

dow and nasdaq today