High Momentum US Large Cap Stocks 2025: A Strategic Investment Outlook

author:US stockS -

In the rapidly evolving landscape of the stock market, identifying high momentum US large cap stocks for 2025 is a critical step for investors looking to capitalize on potential market leaders. Large cap stocks, characterized by their market capitalization of over $10 billion, often serve as bellwethers for the overall market. In this article, we delve into the factors that could drive momentum in these stocks and highlight some key players poised for significant growth in the coming years.

Understanding High Momentum Stocks

High momentum stocks are those that have seen a significant increase in their share price over a short period, typically driven by strong fundamental and technical factors. These stocks often outperform the broader market and can offer substantial returns to investors who correctly identify them.

Key Factors Driving Momentum in Large Cap Stocks

Economic Growth: The strength of the US economy is a fundamental driver of large cap stocks. As the economy grows, these companies tend to benefit from increased consumer spending, higher corporate profits, and improved market confidence.

Sector Performance: The performance of individual sectors can significantly influence the momentum of large cap stocks. For instance, technology, healthcare, and consumer discretionary sectors have been strong performers in recent years.

Innovation and Technology: Companies at the forefront of innovation and technology adoption often experience high momentum. These companies can disrupt traditional industries and create new market opportunities.

Dividend Yield: Large cap stocks with strong dividend yields can attract investors seeking stable income. Companies with consistently increasing dividends tend to have higher momentum.

Top High Momentum US Large Cap Stocks for 2025

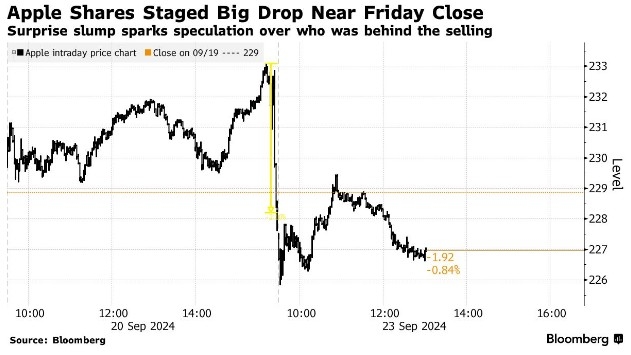

Apple Inc. (AAPL): As the world's largest technology company by market capitalization, Apple continues to innovate in the consumer electronics sector. Its high dividend yield and strong performance in the tech sector make it a strong candidate for high momentum stocks in 2025.

Amazon.com Inc. (AMZN): Amazon, the largest e-commerce company in the world, has a significant presence in various sectors, including cloud computing, streaming, and logistics. Its ongoing expansion into new markets and services could drive high momentum in the coming years.

Microsoft Corporation (MSFT): Microsoft's diversified business model, which includes cloud computing, software, and gaming, has contributed to its strong performance. Its high dividend yield and commitment to innovation position it as a potential high momentum stock in 2025.

Johnson & Johnson (JNJ): As a leader in the healthcare sector, Johnson & Johnson offers a strong dividend yield and consistent growth. Its broad product portfolio, which includes pharmaceuticals, consumer healthcare, and medical devices, makes it a stable investment with potential for high momentum.

Visa Inc. (V): Visa's position as a dominant player in the global payments industry, along with its commitment to innovation and expansion, has contributed to its strong performance. Its potential for high momentum in 2025 is driven by the ongoing growth of digital payments.

In conclusion, identifying high momentum US large cap stocks for 2025 requires a thorough understanding of economic trends, sector performance, and individual company strengths. By focusing on companies with strong fundamentals, innovation, and growth potential, investors can position themselves to capitalize on the potential of these market leaders.

dow and nasdaq today