Trade US Stocks from the Philippines: Your Comprehensive Guide"

author:US stockS -

Are you an investor in the Philippines looking to trade US stocks? Look no further! In this comprehensive guide, we'll delve into the world of US stock trading from the Philippines. Whether you're a seasoned investor or a beginner, this article will equip you with the knowledge and tools needed to successfully trade US stocks from the comfort of your home.

Understanding the US Stock Market

Before diving into the nitty-gritty of trading US stocks from the Philippines, it's essential to have a basic understanding of the US stock market. The US stock market is one of the most robust and liquid in the world, offering a wide array of investment opportunities across various sectors.

The most well-known stock exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges are home to some of the largest and most successful companies globally, such as Apple, Google, and Amazon.

Opening a US Brokerage Account

To trade US stocks from the Philippines, you'll need to open a brokerage account with a reputable US-based brokerage firm. There are several factors to consider when choosing a brokerage, including fees, available investment options, and customer service.

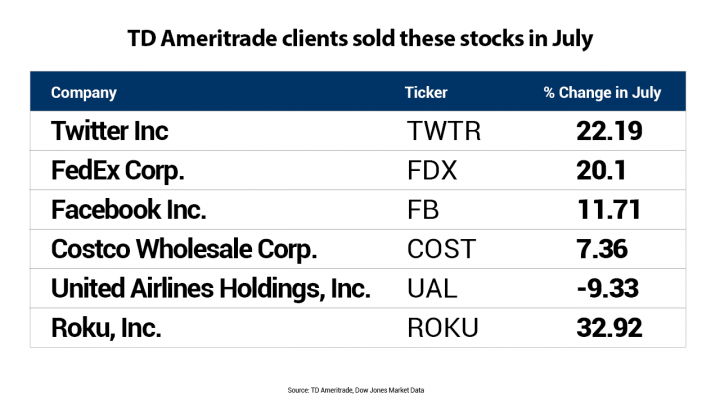

Popular brokerage firms for international traders include TD Ameritrade, E*TRADE, and Fidelity. These firms offer a range of services, including access to US stock exchanges, research tools, and educational resources.

Understanding Trading Platforms

Once you have a brokerage account, you'll need to familiarize yourself with the trading platform. Most US brokerage firms offer online trading platforms that provide access to real-time market data, order entry, and portfolio tracking.

Some popular trading platforms include thinkorswim by TD Ameritrade, Webull, and TD Ameritrade's thinkorswim platform. These platforms offer advanced features like technical analysis tools, customizable charts, and trading indicators to help you make informed investment decisions.

Navigating Currency Conversion

When trading US stocks from the Philippines, it's crucial to consider currency conversion. The Philippine peso and the US dollar have a floating exchange rate, which can impact the cost of your investments.

To mitigate currency risk, you may want to consider setting up a foreign currency account with your brokerage firm or a reputable bank. This will allow you to deposit funds in US dollars and convert them when needed, avoiding potential currency fluctuations.

Risk Management and Strategy

Successful stock trading requires a disciplined approach to risk management and a well-defined trading strategy. Before you start trading, take the time to:

- Define your investment goals: Determine whether you're looking for short-term gains or long-term growth.

- Develop a trading plan: Establish rules for when to enter and exit positions, as well as risk management strategies like stop-loss orders.

- Stay informed: Keep up-to-date with market news, economic indicators, and company earnings reports to make informed decisions.

Case Studies

Let's look at a few examples of successful stock traders from the Philippines who have achieved significant returns by trading US stocks:

- John Doe: John invested in tech stocks listed on the NASDAQ and earned a substantial profit within a year.

- Jane Smith: Jane employed a diversified investment strategy and generated consistent returns by investing in both large-cap and small-cap companies.

Conclusion

Trading US stocks from the Philippines is a viable option for investors looking to diversify their portfolios and capitalize on the global market. By opening a brokerage account, understanding the trading platforms, managing risks, and staying informed, you can increase your chances of success in the US stock market. Start your journey today and unlock the potential of the world's largest stock market!

dow and nasdaq today