Title: BGL US Stock: A Comprehensive Guide to Understanding and Investing

author:US stockS -

Are you looking to invest in the United States stock market? If so, BGL US stock might be a great option for you. But what exactly is BGL US stock, and how can you invest in it? This article will provide you with a comprehensive guide to understanding and investing in BGL US stock.

What is BGL US Stock?

BGL US stock refers to the shares of a company listed on a U.S. stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. The term "BGL" stands for "Buy, Hold, or Sell," which is a strategy used by investors to determine when to buy, hold, or sell their stocks.

Understanding the BGL Strategy

The BGL strategy is a simple yet effective approach to investing in the stock market. It involves three main steps:

- Buy: Invest in a stock when it is undervalued, meaning it is trading below its intrinsic value.

- Hold: Maintain your investment in a stock as long as it continues to perform well and meets your investment criteria.

- Sell: Sell your investment when it has reached its full potential or when it becomes overvalued.

Investing in BGL US Stock

To invest in BGL US stock, you will need to follow these steps:

- Research: Before investing, research the company and its stock to understand its financial health, growth prospects, and market position.

- Open a brokerage account: You will need a brokerage account to buy and sell stocks. Choose a reputable brokerage firm and open an account online.

- Buy BGL US stock: Once you have completed your research and opened a brokerage account, you can buy BGL US stock by placing an order through your brokerage account.

Case Study: BGL US Stock Investment

Let's consider a hypothetical scenario where you have decided to invest in BGL US stock using the BGL strategy.

- Buy: You research BGL and find that it is undervalued. You purchase 100 shares at

50 per share, totaling 5,000. - Hold: Over the next year, BGL's stock price increases to $75 per share. You decide to hold onto your shares, as BGL continues to meet your investment criteria.

- Sell: After another year, BGL's stock price has increased to

100 per share. You decide to sell your shares, realizing a profit of 25,000, or a 500% return on your investment.

Key Considerations When Investing in BGL US Stock

When investing in BGL US stock, there are several key considerations to keep in mind:

- Risk tolerance: Investing in the stock market always involves some level of risk. Make sure you are comfortable with the level of risk associated with your investment.

- Diversification: Diversify your portfolio by investing in a variety of stocks and sectors to reduce your risk.

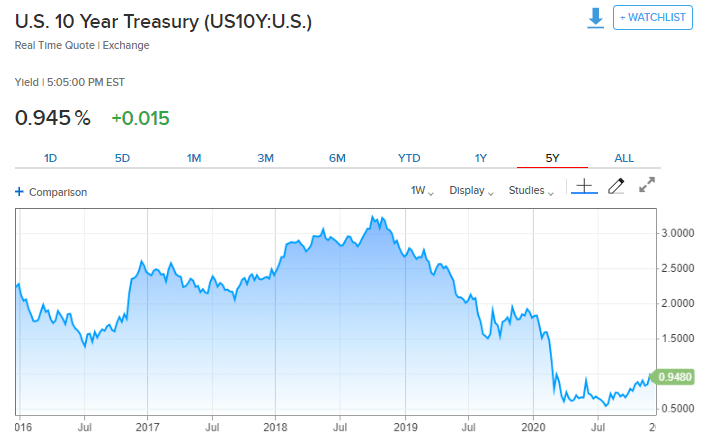

- Market conditions: Stay informed about market conditions and economic indicators that may impact BGL's stock price.

By following the BGL strategy and conducting thorough research, you can make informed decisions when investing in BGL US stock. With the right approach, you can potentially achieve significant returns on your investment.

dow and nasdaq today