Are Chinese Stocks Effected by US Stocks?

author:US stockS -

In the ever-evolving global financial market, the relationship between Chinese and US stocks has become a crucial topic for investors. This article delves into the factors influencing this interconnectivity, providing insights into how US stock market movements can impact the Chinese market.

Understanding the Interdependence

The interdependence between Chinese and US stocks is undeniable. Both markets are highly interconnected due to the increasing globalization of the economy. Key factors contributing to this relationship include:

Trade Tensions: Trade disputes between the two nations can significantly affect stock prices. For example, when the US imposed tariffs on Chinese goods, it led to a decline in Chinese stock market indices.

Technological Advancements: Technological collaboration between US and Chinese companies has created a symbiotic relationship. Any news regarding technological advancements in the US can positively or negatively impact Chinese tech stocks.

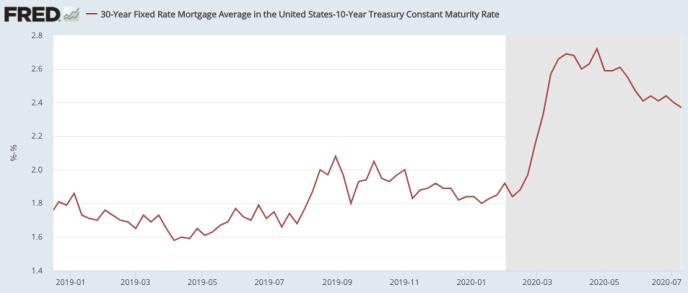

Economic Policies: Economic policies implemented by the US Federal Reserve and the People's Bank of China (PBOC) have a direct impact on stock markets. For instance, changes in interest rates can influence investor sentiment and stock prices in both markets.

Impact of US Stock Market Movements on Chinese Stocks

The movement of the US stock market can have a profound impact on Chinese stocks. Here's how:

Market Sentiment: Market sentiment in the US can quickly spread to the Chinese market. A positive sentiment in the US can lead to increased confidence among Chinese investors, potentially boosting stock prices.

Investor Behavior: Investor behavior is influenced by global events. When the US stock market experiences a downturn, investors may become cautious and pull out of Chinese stocks, leading to a decline in prices.

Currency Fluctuations: Currency fluctuations between the US dollar and the yuan can impact Chinese stocks. A stronger yuan can make Chinese stocks more expensive for foreign investors, potentially leading to a decrease in demand.

Case Studies

To illustrate the impact of US stocks on Chinese stocks, let's consider a few case studies:

Trade War Impact: During the trade war between the US and China in 2019, Chinese stock market indices experienced a significant decline. This decline was attributed to the uncertainty and market sentiment caused by the trade tensions.

COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in 2020 had a global impact on stock markets. Chinese stocks were not immune, as the pandemic caused a decline in investor confidence and a decrease in demand for goods and services.

Conclusion

In conclusion, the relationship between Chinese and US stocks is complex and multifaceted. Understanding the factors influencing this interdependence is crucial for investors. By keeping a close eye on US stock market movements and economic policies, investors can better navigate the Chinese market and make informed decisions.

dow and nasdaq today