The Biggest Stock Brokerage Firms in the US: A Comprehensive Guide

author:US stockS -

In the vast and dynamic world of stock brokerage, certain firms have stood out as the biggest players in the United States. These giants not only offer a wide range of financial services but also shape the landscape of the stock market. This guide delves into the top stock brokerage firms in the US, highlighting their services, strengths, and impact on the financial world.

1. Charles Schwab

As one of the most recognized names in the industry, Charles Schwab has been a leader in the stock brokerage sector for decades. With a vast array of investment options and tools, Schwab caters to both retail and institutional clients. Their robust trading platform, Schwab Mobile, provides users with seamless access to the markets, making it a favorite among active traders.

2. Fidelity Investments

Fidelity Investments is another behemoth in the US stock brokerage space. Known for its user-friendly interface and extensive research tools, Fidelity offers a comprehensive suite of services, including retirement planning, mutual funds, and brokerage services. Their award-winning platform, Fidelity Active Trader Pro, is a favorite among professional traders.

3. TD Ameritrade

TD Ameritrade has earned a reputation for its powerful trading tools and exceptional customer service. The firm’s thinkorswim platform is particularly popular among advanced traders, offering a wide range of analytical tools and customization options. TD Ameritrade also provides educational resources and market insights, making it an excellent choice for both beginners and seasoned investors.

4. E*TRADE

ETRADE has been a staple in the brokerage industry since its inception in 1996. The firm offers a range of investment options, from stocks and bonds to mutual funds and exchange-traded funds (ETFs). Their award-winning platform, ETRADE Web, provides users with real-time quotes, streaming market data, and a variety of analytical tools.

5. Merrill Edge

A joint venture between Bank of America and Merrill Lynch, Merrill Edge combines the resources of a global financial institution with the convenience of online brokerage services. The platform offers a range of investment options, from stocks and bonds to ETFs and mutual funds. Merrill Edge is particularly well-suited for investors who value personalized advice and a comprehensive approach to financial planning.

Case Study: Fidelity's Impact on the Stock Market

To illustrate the impact of these brokerage firms, let's consider Fidelity Investments. In 2018, Fidelity was involved in a significant merger with Charles Schwab. This merger aimed to create a more robust and competitive financial services company. As a result, Fidelity's market presence grew significantly, and its offerings expanded to include a broader range of services and products.

The merger also allowed Fidelity to leverage its extensive resources and expertise to enhance its trading platform and customer experience. This, in turn, attracted a larger customer base and solidified Fidelity's position as a leading stock brokerage firm in the US.

In conclusion, the biggest stock brokerage firms in the US have played a pivotal role in shaping the financial landscape. With their extensive services, innovative platforms, and personalized advice, these firms have become go-to destinations for investors of all levels. Whether you're an active trader or a long-term investor, these firms offer the tools and resources needed to achieve your financial goals.

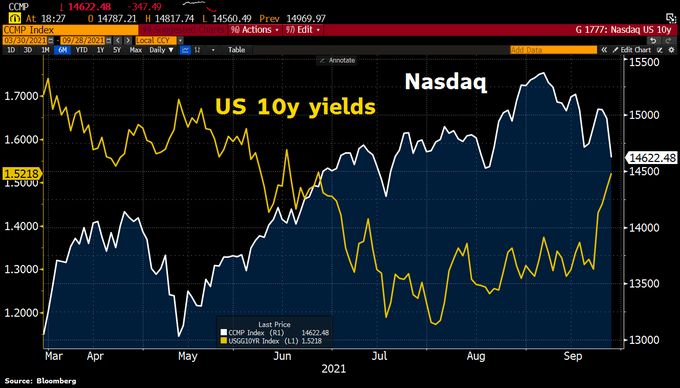

dow and nasdaq today