US-China Trade Talks: Impact on Markets and Stocks

author:US stockS -

The ongoing US-China trade talks have been a major topic of discussion in the financial world, with investors and market experts eagerly awaiting any news that might impact their portfolios. In this article, we delve into the potential effects of these negotiations on the stock market and global financial markets.

Background of US-China Trade Tensions

The relationship between the United States and China has been strained in recent years, primarily due to trade disputes. These tensions escalated in 2018, when the Trump administration imposed tariffs on Chinese goods, prompting Beijing to retaliate with its own tariffs. This led to a protracted trade war that has caused uncertainty and volatility in global markets.

Potential Outcomes of the Trade Talks

The US-China trade talks have the potential to bring about several outcomes, each with varying implications for the stock market and global financial markets.

1. Positive Outcome: A positive outcome would involve a comprehensive trade deal that addresses the key concerns of both countries. This could lead to a significant reduction in tariffs and a return to normal trade relations. Such a deal would likely boost investor confidence and lead to a surge in stock prices, as companies would benefit from lower costs and increased access to the Chinese market.

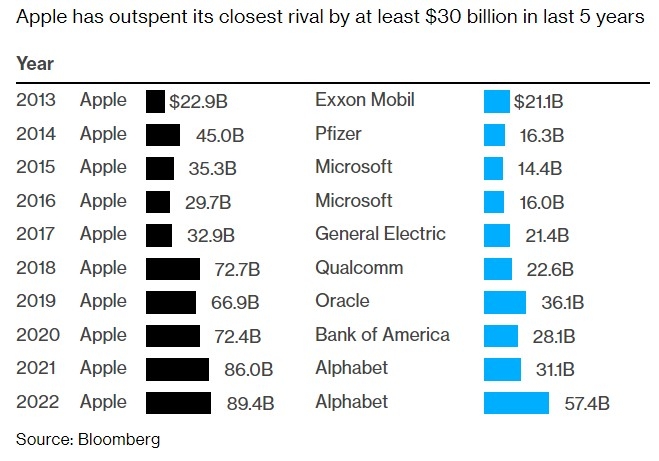

Example: Companies like Apple, which relies heavily on Chinese manufacturing, could see their stock prices rise if the trade deal reduces tariffs and improves market access in China.

2. Negotiation Failure: If the negotiations fail to reach a mutually acceptable agreement, the situation could worsen, leading to an escalation in tariffs and trade restrictions. This would likely lead to a slowdown in global economic growth and a decline in stock prices, as companies face higher costs and reduced demand.

Example: Tech giant Huawei, which has been at the center of the trade tensions, could suffer further losses if the negotiations fail, leading to a decline in its stock price.

3. Partial Agreement: A partial agreement could provide some relief but also leave room for uncertainty and further negotiations. This scenario would likely lead to a mixed reaction in the stock market, with some sectors benefiting from reduced tariffs while others remain vulnerable to trade tensions.

Impact on Different Sectors

The impact of the US-China trade talks on various sectors can be significant:

- Technology: Tech companies that rely heavily on the Chinese market, such as Apple and Microsoft, would likely benefit from a positive outcome.

- Consumer Goods: Companies that produce consumer goods for the Chinese market, such as Procter & Gamble and Coca-Cola, could see increased demand if trade tensions ease.

- Automotive: Automakers like Ford and General Motors would benefit from reduced tariffs and improved market access in China.

Conclusion

The outcome of the US-China trade talks remains uncertain, but it is clear that the negotiations will have a significant impact on the stock market and global financial markets. As investors, it is crucial to stay informed and prepared for potential market volatility in the coming months.

dow and nasdaq today