Pre-Inflation Data: A Key Insight into US Stock Futures

author:US stockS -

In the volatile world of financial markets, staying ahead of the curve is crucial for investors. One of the most anticipated indicators in the United States is pre-inflation data, which plays a pivotal role in shaping stock futures. This article delves into the significance of pre-inflation data and its impact on US stock futures, providing investors with valuable insights.

Understanding Pre-Inflation Data

Pre-inflation data refers to economic indicators that are released before the Consumer Price Index (CPI) or other inflation measures are published. These indicators, such as the Producer Price Index (PPI), Retail Sales, and Initial Jobless Claims, offer a sneak peek into the current economic conditions and inflation trends. By analyzing these data points, investors can gain a better understanding of the potential direction of stock futures.

The Role of Pre-Inflation Data in Stock Futures

Market Sentiment: Pre-inflation data can significantly influence market sentiment. For instance, if the data shows strong economic growth and rising inflation, it may lead to a bullish sentiment in the stock market. Conversely, weak inflation data may result in a bearish outlook.

Central Bank Policy: The Federal Reserve closely monitors pre-inflation data to make informed decisions about monetary policy. If the data indicates higher inflation, the Fed may raise interest rates, which can negatively impact stock futures. Conversely, lower inflation may lead to rate cuts, boosting stock market optimism.

Sector Rotation: Pre-inflation data can also guide investors in sector rotation. For example, during periods of rising inflation, sectors like energy and materials may outperform, while consumer discretionary sectors may lag.

Analyzing Pre-Inflation Data

To effectively utilize pre-inflation data, investors should consider the following aspects:

Historical Context: Compare the current data with historical trends to identify patterns and outliers.

Market Reactions: Analyze how the market has reacted to similar data in the past to gauge potential future movements.

Economic Indicators: Combine pre-inflation data with other economic indicators to form a comprehensive picture of the market.

Case Studies

Let's consider a few case studies to illustrate the impact of pre-inflation data on US stock futures:

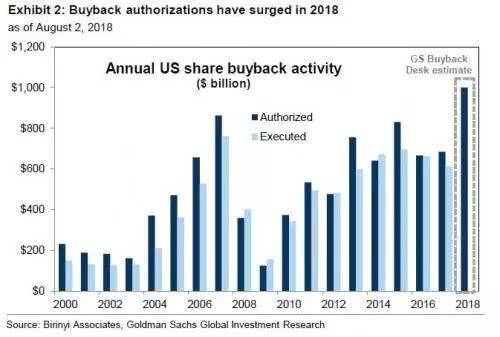

2018 Inflation Concerns: In late 2018, pre-inflation data, particularly the PPI, indicated rising inflation trends. This led to concerns about the Federal Reserve raising interest rates, which caused a sell-off in the stock market.

2020 Economic Recovery: In the wake of the COVID-19 pandemic, pre-inflation data, such as Retail Sales and Initial Jobless Claims, provided insights into the economic recovery. As the data improved, stock futures began to rise, reflecting market optimism.

In conclusion, pre-inflation data is a valuable tool for investors seeking to gain insights into US stock futures. By analyzing this data and its implications, investors can make more informed decisions and stay ahead of the market curve.

dow and nasdaq today