2025 US Stock Market Crash: Reasons to Watch Out

author:US stockS -

The US stock market has been a beacon of economic strength, offering investors a wide array of opportunities for growth and profitability. However, there's a lingering concern among many experts: the possibility of a stock market crash in 2025. In this article, we will delve into the potential reasons behind such a scenario, offering insights that could help you stay ahead of the curve.

1. Economic Slowdown One of the most prevalent reasons for a potential stock market crash is an economic slowdown. Factors such as rising interest rates, increased inflation, and decreasing consumer spending can contribute to a slowing economy. As the Federal Reserve continues to adjust its monetary policy, the stock market could face significant volatility.

2. Geopolitical Tensions Geopolitical tensions, such as those between major economies like the US and China, can lead to uncertainty in the global markets. This uncertainty can spill over into the US stock market, leading to a crash. For instance, a trade war or political instability in a major economy could trigger a ripple effect that affects the US markets.

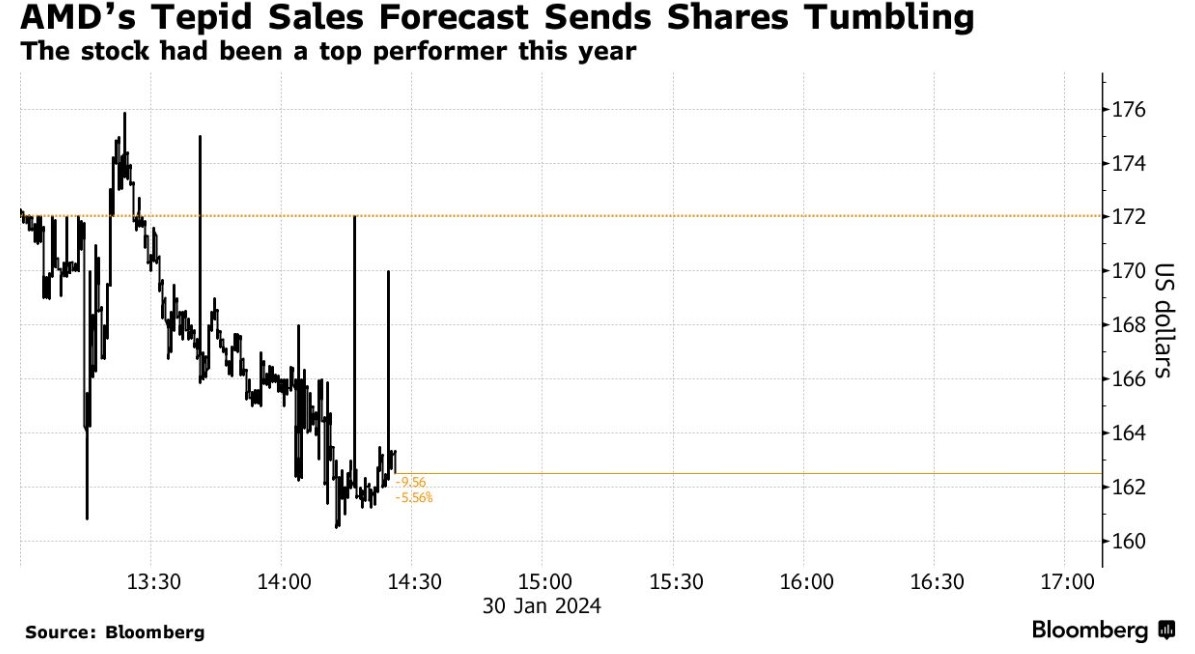

3. Technology Disruptions The technology sector has been a major driver of the US stock market's growth over the past few years. However, any disruptions in the technology industry, such as a major company collapse or a cybersecurity attack, could send shockwaves through the entire market.

4. Corporate Earnings Corporate earnings play a crucial role in driving stock prices. If companies start to report lower-than-expected earnings, investors might lose confidence in the market, leading to a potential crash. This is especially true if the trend of declining earnings persists over an extended period.

5. Market Valuations The stock market is currently valued at an all-time high. While this might be seen as a sign of strong economic performance, it also makes the market more vulnerable to a crash. Overvalued stocks can attract speculators, which can lead to excessive price volatility and eventually a crash.

6. High Levels of Debt High levels of debt, both in the corporate and consumer sectors, can put a strain on the economy. As companies and individuals struggle to repay their debts, the stock market could face downward pressure.

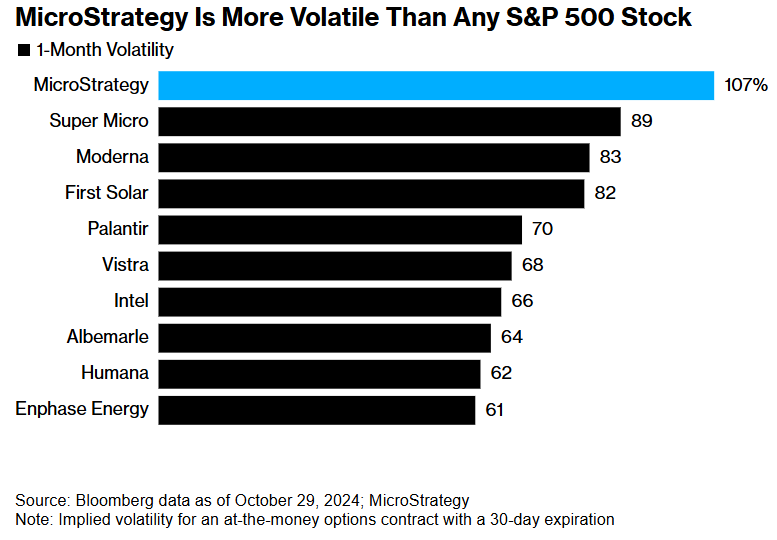

7. Cryptocurrency Volatility The rise of cryptocurrencies has introduced a new layer of volatility to the financial markets. As cryptocurrencies become more mainstream, their volatility could have a spillover effect on the traditional stock market.

Case Studies

*2008 Financial Crisis: One of the most significant stock market crashes in history occurred in 2008. The crash was triggered by the collapse of the housing market, leading to a widespread financial crisis. The crash was primarily caused by excessive risk-taking, lack of regulatory oversight, and poor risk management. *2020 Pandemic-Induced Crash: The COVID-19 pandemic led to a sharp downturn in the stock market, with the S&P 500 falling over 30% in a matter of weeks. The crash was caused by widespread panic, supply chain disruptions, and fears of a prolonged economic downturn.

Conclusion

While predicting a stock market crash is a challenging task, it's crucial for investors to be aware of the potential risks. By understanding the factors that could lead to a crash, investors can make more informed decisions and better protect their portfolios. As we approach 2025, staying vigilant and well-informed will be more important than ever.

dow and nasdaq today