Understanding the US FDI Stock: A Comprehensive Guide

author:US stockS -

In the ever-evolving global economy, Foreign Direct Investment (FDI) plays a crucial role in the growth and development of countries. The United States, being one of the world's leading economies, attracts a significant amount of FDI. This article aims to provide a comprehensive understanding of the US FDI stock, its significance, and its impact on the American economy.

What is US FDI Stock?

The US FDI stock refers to the total value of foreign investments in the United States. It includes investments made by foreign companies in various sectors such as manufacturing, finance, real estate, and services. The stock is measured in terms of the net assets owned by foreign entities in the United States.

Significance of US FDI Stock

Economic Growth: FDI has been a major driver of economic growth in the United States. It brings in capital, technology, and expertise, which helps in creating jobs and boosting productivity.

Job Creation: FDI generates employment opportunities in various sectors. According to the U.S. Chamber of Commerce, FDI supports approximately 12 million American jobs.

Technological Transfer: FDI facilitates the transfer of technology and knowledge from foreign companies to the United States. This helps in improving the competitiveness of American firms.

Trade Balance: FDI contributes to the trade balance by generating exports. Foreign companies operating in the United States often export their products and services to other countries.

Impact of US FDI Stock on the Economy

Manufacturing Sector: The manufacturing sector is one of the major recipients of FDI in the United States. Companies like Toyota, BMW, and Honda have established manufacturing facilities in the country, leading to job creation and technological transfer.

Finance Sector: The finance sector has also seen significant FDI, with foreign banks and financial institutions setting up operations in the United States. This has increased the competitiveness of the American financial industry.

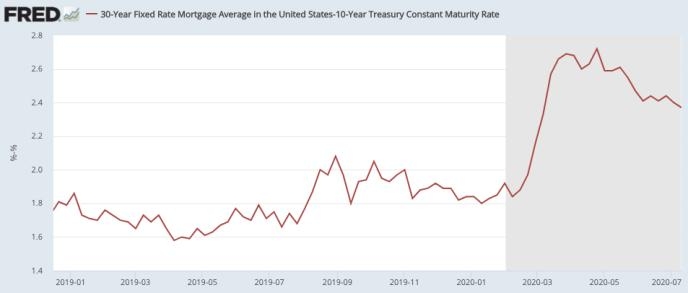

Real Estate Sector: FDI has been a major driver of growth in the real estate sector. Foreign investors have been actively investing in residential and commercial properties, contributing to the real estate market.

Case Studies

Toyota: Toyota's manufacturing plant in Kentucky is a classic example of how FDI can contribute to economic growth. The plant employs over 5,000 workers and generates billions of dollars in economic activity.

Volkswagen: Volkswagen's manufacturing plant in Chattanooga, Tennessee, has been a significant contributor to the state's economy. The plant employs over 3,000 workers and has a significant impact on the local supply chain.

Conclusion

The US FDI stock is a crucial component of the American economy. It drives economic growth, creates jobs, and enhances technological transfer. As the global economy continues to evolve, the importance of FDI in the United States will only increase.

dow and nasdaq today