PLL US Stock Price: A Comprehensive Analysis

author:US stockS -

The stock market is a dynamic and complex environment, where investors continuously seek opportunities to maximize their returns. One such opportunity is the stock of PLL Corporation (PLL), a leading aerospace and defense technology company. In this article, we will delve into the factors influencing the PLL US stock price and provide a comprehensive analysis of its current market standing.

Understanding PLL Corporation

PLL Corporation, founded in 1946, is a leading provider of advanced aerospace and defense products and services. The company specializes in the design, development, and manufacture of high-performance electronics and sensors. With a diverse customer base that includes the U.S. Department of Defense and other global defense organizations, PLL has established itself as a key player in the aerospace and defense industry.

Factors Influencing the PLL US Stock Price

Several factors can influence the PLL US stock price, including:

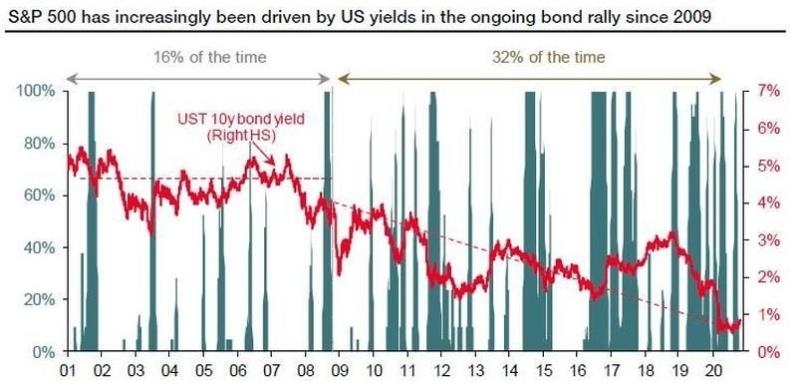

Economic Conditions: The overall economic conditions, such as GDP growth, inflation, and interest rates, can have a significant impact on the stock price. A strong economy can lead to increased demand for defense products, while a weak economy may have the opposite effect.

Industry Trends: The aerospace and defense industry is subject to various trends, such as increased spending on defense by governments around the world and advancements in technology. These trends can directly impact the demand for PLL's products and services.

Company Performance: The financial performance of PLL, including revenue, earnings, and margins, is a crucial factor in determining its stock price. Strong financial results can lead to increased investor confidence and a higher stock price.

Market Sentiment: The overall sentiment in the stock market can also influence the PLL US stock price. Positive sentiment can drive the stock higher, while negative sentiment can lead to a decline.

Current Market Standing of PLL Corporation

As of the latest available data, the PLL US stock price has been fluctuating in a range of

Economic Uncertainty: The ongoing global economic uncertainty, particularly due to the COVID-19 pandemic, has created a volatile environment for the stock market. This uncertainty has impacted the aerospace and defense industry, including PLL.

Company Performance: While PLL has reported strong financial results in recent quarters, investors remain cautious due to the uncertain economic outlook.

Market Sentiment: The overall sentiment in the stock market has been mixed, with some investors remaining optimistic about the long-term prospects of the aerospace and defense industry, while others remain concerned about short-term volatility.

Case Studies

To better understand the factors influencing the PLL US stock price, let's look at a couple of case studies:

Defense Spending Increase: In 2018, the U.S. Department of Defense announced an increase in defense spending. This news positively impacted the PLL US stock price, as it indicated increased demand for the company's products and services.

COVID-19 Pandemic: The COVID-19 pandemic has created a volatile environment for the stock market, including the PLL US stock price. While the company has reported strong financial results in recent quarters, investors remain cautious due to the uncertain economic outlook.

Conclusion

The PLL US stock price is influenced by a variety of factors, including economic conditions, industry trends, company performance, and market sentiment. As investors, it is crucial to stay informed about these factors and analyze them to make informed investment decisions. By understanding the dynamics of the stock market and the specific factors influencing the PLL US stock price, investors can better position themselves to capitalize on opportunities in the aerospace and defense industry.

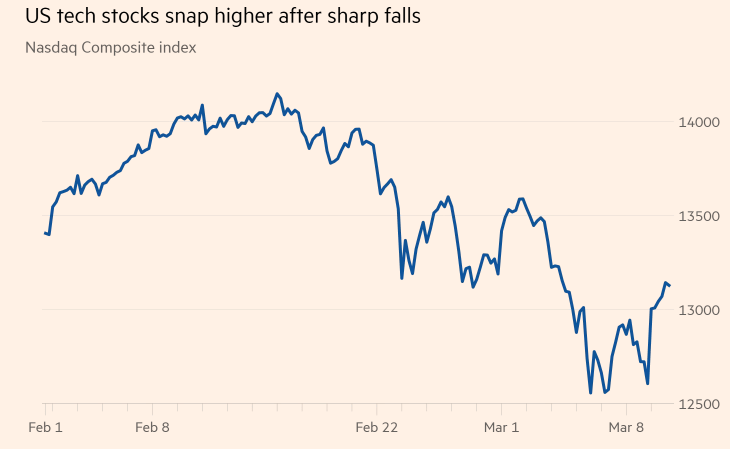

dow and nasdaq today