Does Silver Trade on the US Stock Exchange?

author:US stockS -

Understanding the Silver Market on Wall Street

In the world of finance, silver has long been a popular investment choice. Many investors wonder if they can trade silver on the US stock exchange. The answer is yes, and this article will delve into how silver is traded, the benefits of investing in silver stocks, and the risks involved.

Trading Silver on the US Stock Exchange

Silver, like gold, is often considered a safe haven investment. It is traded on the US stock exchange through silver stocks, which represent ownership in silver mining companies or silver ETFs (Exchange Traded Funds). Here's how you can trade silver on the US stock exchange:

Silver Stocks: Investors can buy shares of silver mining companies that extract and refine silver. These companies often list their stocks on major exchanges like the New York Stock Exchange (NYSE) or the NASDAQ.

Silver ETFs: ETFs are a popular way to invest in silver without owning physical silver. Silver ETFs track the price of silver and are traded like stocks. Popular silver ETFs include the iShares Silver Trust (SLV) and the SPDR Gold Trust (GLD).

Benefits of Investing in Silver Stocks

Investing in silver stocks offers several benefits:

Diversification: Silver can diversify your investment portfolio, reducing your exposure to market volatility.

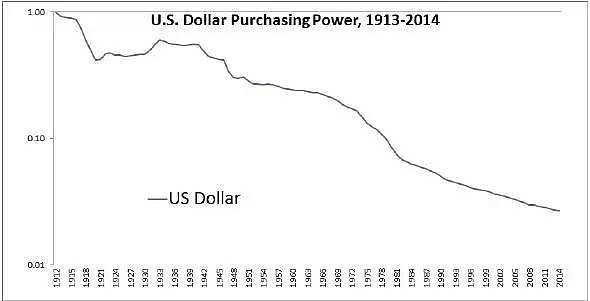

Hedge Against Inflation: Silver is often seen as a hedge against inflation, as its value tends to increase during periods of high inflation.

Potential for Growth: The silver market has seen significant growth in recent years, offering potential for high returns.

Risks of Investing in Silver Stocks

While investing in silver stocks can be lucrative, it also comes with risks:

Market Volatility: The silver market can be highly volatile, with prices fluctuating rapidly.

Political and Economic Factors: Changes in global politics and economic conditions can impact the silver market.

Company-Specific Risks: Investing in individual silver mining companies involves risks associated with the company's operations and management.

Case Study: Pan American Silver Corporation

One notable silver mining company is Pan American Silver Corporation (PAAS). Founded in 1990, PAAS is one of the largest silver mining companies in the world. Here's how PAAS has performed over the years:

- 2000-2008: PAAS experienced significant growth during this period, with its stock price rising from around

1 to over 50. - 2008-2011: The global financial crisis impacted PAAS, with its stock price falling to around $5.

- 2011-Present: PAAS has since recovered, with its stock price reaching new highs.

This case study illustrates the potential for both growth and volatility in the silver market.

Conclusion

In conclusion, silver can indeed be traded on the US stock exchange through silver stocks and ETFs. While investing in silver stocks offers potential benefits, it also comes with risks. As with any investment, it's crucial to do thorough research and consider your financial goals and risk tolerance before investing in silver stocks.

dow and nasdaq today