The Growing Number of Active Stock Traders in the US

author:US stockS -

In today's rapidly evolving financial landscape, the number of active stock traders in the United States has been on the rise. This surge can be attributed to a variety of factors, including technological advancements, increased accessibility to trading platforms, and a growing interest in personal finance management. This article delves into the reasons behind this trend and explores its implications for the financial industry.

Technological Advancements and Accessibility

One of the primary reasons for the increase in the number of active stock traders is the advancements in technology. Today, individuals can trade stocks from the comfort of their homes, using user-friendly online platforms and mobile applications. These platforms often come with real-time market data, analytical tools, and educational resources, making it easier for beginners to enter the market.

The Rise of Robo-Advisors

Robo-advisors have also played a significant role in the growth of active stock traders. These automated investment platforms offer low-cost investment advice and portfolio management, making it more accessible for individuals to invest in the stock market. According to a report by the Investment Company Institute, the assets managed by robo-advisors in the United States reached $1.1 trillion as of the end of 2020.

Educational Resources and Online Communities

The availability of educational resources and online communities has also contributed to the increase in active stock traders. Websites, forums, and social media platforms offer valuable insights, trading strategies, and advice from experienced traders. This has helped demystify the stock market and encouraged more individuals to participate in trading.

Implications for the Financial Industry

The growing number of active stock traders has several implications for the financial industry. Firstly, it has led to increased competition among brokerage firms, as they strive to attract and retain customers. This competition has resulted in lower trading fees and more innovative trading tools and services.

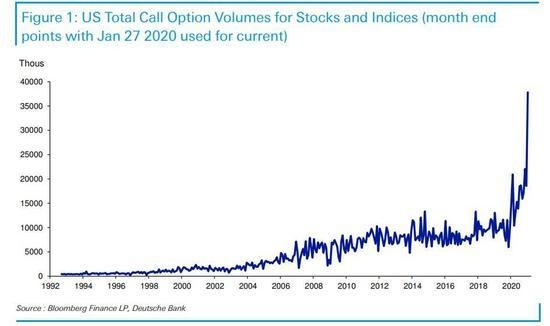

Secondly, the rise of active stock traders has led to increased market volatility. As more individuals trade, the demand and supply for stocks can fluctuate rapidly, leading to significant price movements. This volatility can present both opportunities and risks for investors.

Case Study: The Impact of Retail Traders on the Stock Market

One notable example of the impact of retail traders on the stock market is the GameStop saga. In early 2021, retail traders on platforms like Reddit's WallStreetBets community organized to purchase shares of GameStop, driving the stock's price to unprecedented levels. This event highlighted the growing influence of retail traders in the stock market and sparked discussions about market manipulation and regulatory measures.

Conclusion

The increasing number of active stock traders in the United States is a testament to the changing landscape of the financial industry. With advancements in technology, increased accessibility, and a growing interest in personal finance management, it is likely that this trend will continue. As more individuals enter the stock market, the industry will need to adapt to meet their evolving needs and ensure fair and transparent trading practices.

dow and nasdaq today