In the dynamic world of finance, insurance companies have emerged as significant players in the stock market. These financial institutions, traditionally known for their conservative investment strategies, have increasingly shown a penchant for investing in US stocks. This article delves into the reasons behind this shift, the potential risks involved, and the impact on the stock market.

Why Insurance Companies Are Investing in US Stocks

1. Diversification

One of the primary reasons insurance companies are investing in US stocks is to diversify their portfolios. By allocating a portion of their funds to equities, they can reduce their exposure to the volatility of fixed-income securities. This diversification strategy helps in mitigating risks and achieving long-term growth.

2. Yield

Investing in US stocks offers insurance companies the opportunity to earn higher yields compared to traditional fixed-income investments. The stock market has historically provided higher returns, making it an attractive option for these companies to generate additional income.

3. Regulatory Changes

Regulatory changes have also played a crucial role in encouraging insurance companies to invest in US stocks. The introduction of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 912 has allowed insurance companies to recognize investment income more quickly, making stocks a more viable investment option.

The Risks Involved

Despite the potential benefits, investing in US stocks also comes with its own set of risks. Insurance companies must be cautious about the following:

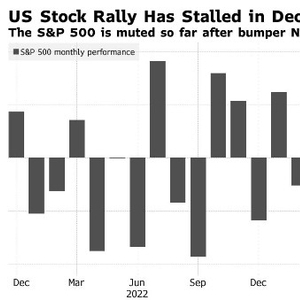

1. Market Volatility

The stock market is known for its volatility, and insurance companies must be prepared for sudden market downturns. A decline in stock prices can significantly impact their investment returns and financial stability.

2. Credit Risk

Insurance companies must also consider the credit risk associated with their investments. Investing in stocks of companies with poor credit ratings can lead to financial losses.

3. Liquidity Risk

Liquidity risk is another concern for insurance companies. They must ensure that they can easily sell their investments without causing significant market disruptions or incurring losses.

Impact on the Stock Market

The increased investment by insurance companies in US stocks has had a notable impact on the market. Here are a few key points:

1. Increased Liquidity

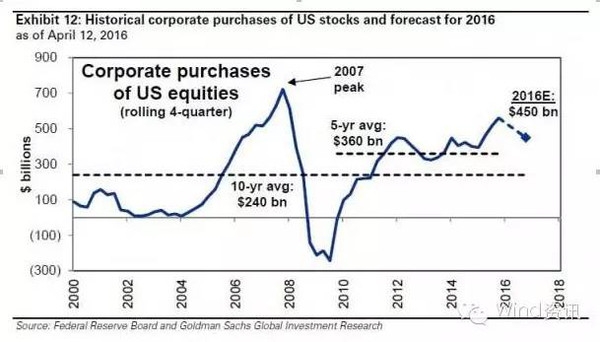

Insurance companies have provided additional liquidity to the stock market, making it easier for companies to raise capital and expand their operations.

2. Higher Stock Prices

The increased demand for stocks has led to higher prices, benefiting existing shareholders and encouraging more companies to go public.

3. Market Stability

Insurance companies' investment in US stocks has contributed to market stability, as these institutions are known for their long-term investment horizon.

Case Studies

Several insurance companies have successfully invested in US stocks, achieving significant returns. For instance, Prudential Financial, one of the largest life and health insurance companies in the US, has allocated a substantial portion of its portfolio to stocks. This strategy has helped the company generate substantial returns over the years.

Similarly, MetLife, another leading insurance company, has invested heavily in US stocks, diversifying its portfolio and achieving long-term growth.

In conclusion, insurance companies' investment in US stocks has become a significant trend in the financial industry. While there are risks involved, the potential benefits make it an attractive option for these institutions. As the stock market continues to evolve, insurance companies will likely play an even more significant role in shaping its future.

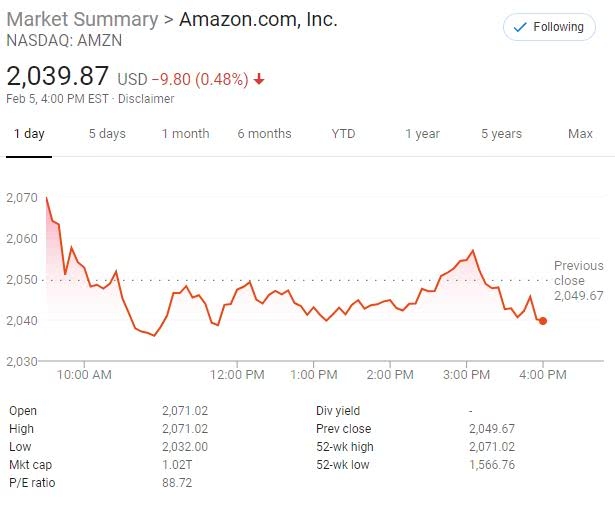

dow and nasdaq today