Title: Chinese Buying US Stock: A Comprehensive Insight

author:US stockS -

Introduction

In recent years, there has been a significant increase in Chinese investors purchasing U.S. stocks. This trend has captured the attention of financial experts and investors worldwide, prompting a deeper understanding of the reasons behind this growing interest. This article delves into the factors driving Chinese investors to buy U.S. stocks and explores the potential impacts on the global financial market.

Economic Growth and Investment Opportunities

Economic Growth: China's economy has been experiencing rapid growth over the past few decades, making it the second-largest economy in the world. As a result, Chinese investors are seeking new avenues for investment to diversify their portfolios and capitalize on the growing global economy.

Investment Opportunities: The U.S. stock market is widely regarded as one of the most stable and liquid markets in the world. It offers a wide range of investment opportunities across various sectors, from technology to healthcare, making it an attractive destination for Chinese investors.

Currency Fluctuations and Return on Investment

Currency Fluctuations: The Chinese Renminbi (CNY) has experienced significant fluctuations against the U.S. Dollar (USD) over the years. When the CNY strengthens against the USD, it becomes more cost-effective for Chinese investors to invest in U.S. stocks, leading to higher returns.

Return on Investment: Historically, U.S. stocks have offered higher returns compared to Chinese stocks. This has prompted Chinese investors to seek out U.S. stocks as a means to maximize their returns.

Diversification and Risk Management

Diversification: Chinese investors often seek to diversify their portfolios to mitigate risks associated with a single market. The U.S. stock market provides a platform for diversification, allowing investors to allocate their investments across different sectors and geographical locations.

Risk Management: The U.S. stock market has robust regulatory frameworks in place, which help protect investors from fraud and manipulation. This provides Chinese investors with a level of confidence and security that may not be as readily available in other markets.

Impact on the U.S. Stock Market

The increasing number of Chinese investors buying U.S. stocks has had a notable impact on the U.S. stock market. This trend has led to an increase in liquidity, driving up stock prices and benefiting U.S. companies.

Case Studies

Alibaba: In 2014, Chinese e-commerce giant Alibaba went public on the New York Stock Exchange, raising $21.8 billion. This was the largest IPO in U.S. history at the time. The listing of Alibaba in the U.S. stock market allowed Chinese investors to gain exposure to one of the most successful e-commerce companies in the world.

JD.com: Another notable example is JD.com, a Chinese e-commerce company that went public on the NASDAQ in 2014. The listing of JD.com provided Chinese investors with access to one of the fastest-growing e-commerce platforms in China.

Conclusion

The increasing number of Chinese investors buying U.S. stocks is a testament to the growing economic ties between China and the U.S. As the trend continues to evolve, it is crucial for investors and financial experts to stay informed about the factors driving this trend and its potential impacts on the global financial market.

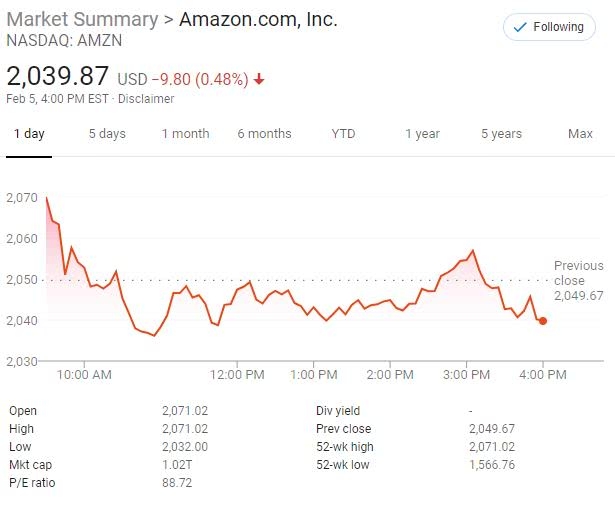

dow and nasdaq today