Index Fund with Us and International Stock: A Smart Investment Strategy

author:US stockS -

Investing in the stock market can be daunting, especially for beginners. However, with the right strategy and tools, you can navigate the waters of international stock markets with ease. One such tool is an index fund, which offers a diverse and cost-effective way to invest in both U.S. and international stocks. In this article, we'll explore the benefits of index funds, how to get started, and some key factors to consider when investing in international stocks.

Understanding Index Funds

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500 or the MSCI World. By investing in an index fund, you gain exposure to a broad range of stocks, which can reduce risk and provide diversification.

Diversification: A Key Benefit

One of the primary advantages of index funds is diversification. By investing in a wide array of stocks, you reduce the risk associated with any single stock's performance. This is particularly beneficial when investing in international stocks, as it mitigates the impact of political, economic, and currency fluctuations in specific countries.

Investing in U.S. and International Stocks

When investing in international stocks, it's important to consider both U.S. and international markets. Here are some key factors to keep in mind:

Currency Fluctuations: The value of your investment can be affected by currency fluctuations. When investing in international stocks, you're exposed to the risks and rewards of foreign currencies.

Political and Economic Stability: Countries with stable political and economic systems tend to offer more predictable markets. Researching the political and economic climate of each country you're considering can help you make informed decisions.

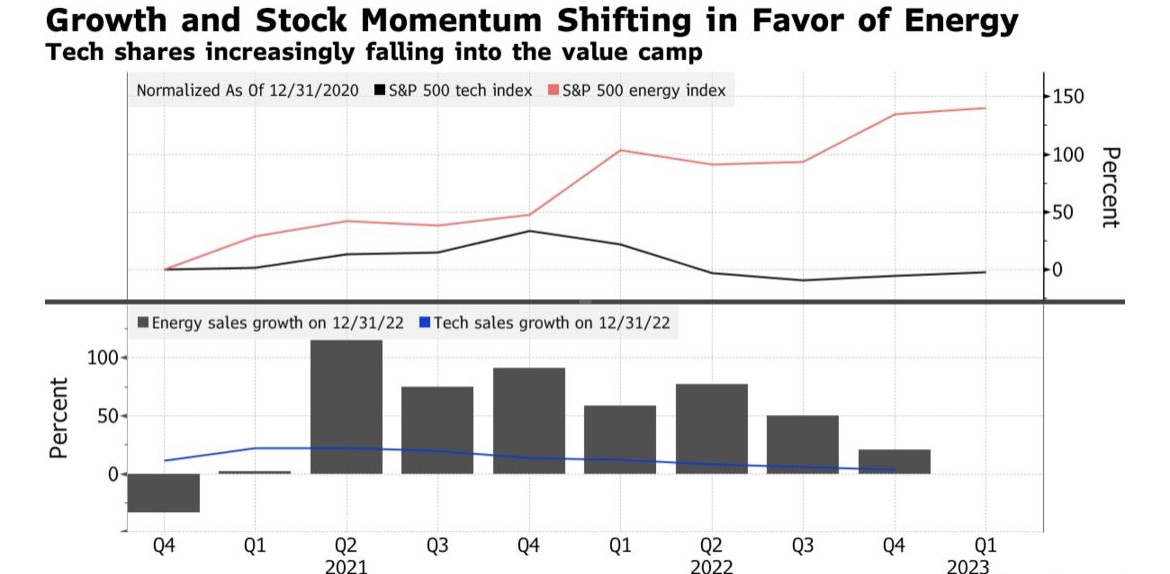

Sector Performance: Different sectors perform differently in different regions. For example, technology companies may thrive in certain countries, while healthcare or energy companies may be more prominent in others.

Getting Started with Index Funds

To get started with index funds, follow these steps:

Research and Choose a Broker: Select a reputable brokerage firm that offers access to a variety of index funds. Many brokers offer a wide range of funds with low fees and easy-to-use platforms.

Open an Account: Once you've chosen a broker, open an investment account. This can typically be done online in just a few minutes.

Allocate Your Portfolio: Determine how much you want to invest in U.S. and international stocks. Many investors allocate a portion of their portfolio to international stocks for diversification.

Invest in Index Funds: Purchase index funds that track the markets you're interested in. Some popular options include the Vanguard Total Stock Market ETF (VTI) for U.S. stocks and the iShares MSCI ACWI ETF (ACWI) for international stocks.

Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

Case Study: Investing in the iShares MSCI ACWI ETF

Consider the iShares MSCI ACWI ETF, which tracks a broad range of global stocks. By investing in this ETF, you gain exposure to a diverse array of companies across various industries and regions. Over the past five years, the ETF has provided a solid return, outperforming many actively managed funds.

In conclusion, index funds are a smart and efficient way to invest in both U.S. and international stocks. By diversifying your portfolio and considering key factors such as currency fluctuations and political stability, you can navigate the complexities of the stock market with confidence. Start your journey towards successful international stock investing today.

dow and nasdaq today