Does the US Government Buy Stocks?

author:US stockS -

The role of the U.S. government in the stock market is a topic of interest for many investors and citizens alike. Does the U.S. government actually buy stocks? The answer may surprise you. In this article, we delve into the government's involvement in the stock market, its impact, and the regulations that govern such transactions.

Understanding the Government's Role

The U.S. government, through various agencies and departments, does engage in the buying of stocks. However, this is not for the sake of personal gain or investment. Instead, these purchases are often strategic and serve a broader purpose.

One of the primary ways the government buys stocks is through its investment funds. For instance, the Social Security Trust Fund has significant investments in U.S. stocks. This fund is a crucial part of the nation's social safety net, providing income for millions of Americans upon retirement.

Social Security Trust Fund

The Social Security Trust Fund is a significant player in the stock market. It invests in a diversified portfolio of U.S. Treasury securities and corporate bonds. Over the years, the fund has grown, and a substantial portion of its investments are in stocks. This is done to ensure the fund's sustainability and to provide a stable income for future retirees.

Treasury Inflation-Protected Securities (TIPS)

Another way the government buys stocks is through the purchase of Treasury Inflation-Protected Securities (TIPS). These are bonds that are indexed to inflation, providing a hedge against rising prices. While TIPS are not technically stocks, they are closely related and often considered part of the stock market's broader investment landscape.

Pension Funds and Other Government Investments

Pension funds for government employees, such as the Federal Employees Retirement System (FERS), also invest in stocks. These funds are designed to provide retirement benefits for federal workers, and stocks are a key component of their investment strategy.

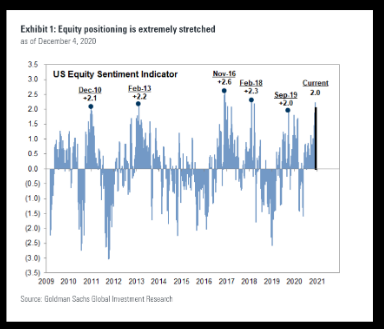

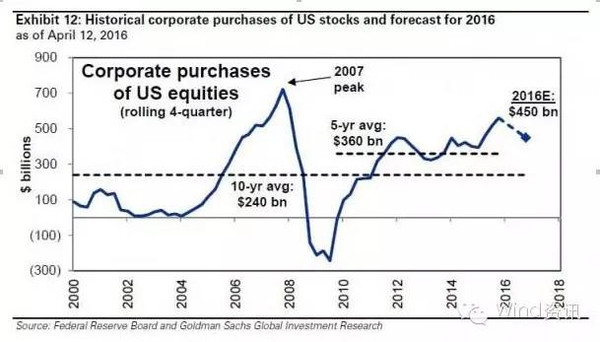

Impact on the Stock Market

The government's buying of stocks can have a significant impact on the stock market. For instance, when the Social Security Trust Fund makes large purchases, it can influence stock prices. However, the government's involvement is not typically for the purpose of driving up prices but rather to ensure the fund's long-term stability.

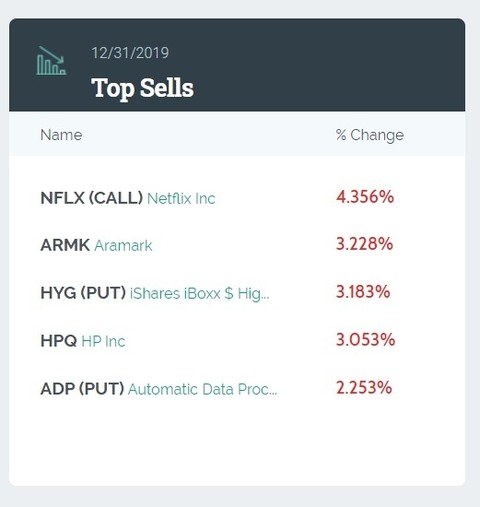

Regulations and Transparency

It's important to note that the government's purchases of stocks are subject to strict regulations. These regulations ensure transparency and prevent any potential conflicts of interest. The Federal Reserve, for example, is responsible for overseeing the government's investments and ensuring compliance with these rules.

Case Study: Federal Reserve's Quantitative Easing

A notable example of the government's influence on the stock market is the Federal Reserve's quantitative easing (QE) program. During the financial crisis of 2008, the Fed engaged in massive bond purchases, which included corporate bonds and mortgage-backed securities. While not stocks per se, these purchases had a similar effect on the market, leading to increased liquidity and, in turn, rising stock prices.

Conclusion

In conclusion, while the U.S. government does buy stocks, its involvement is primarily strategic and serves a broader purpose, such as ensuring the sustainability of the Social Security Trust Fund and providing retirement benefits for government employees. The government's purchases are subject to strict regulations and are not typically aimed at driving up stock prices. Understanding this role is crucial for anyone interested in the intersection of government and the stock market.

dow and nasdaq today