How to Buy US Stocks from Mexico: A Comprehensive Guide

author:US stockS -

Embarking on a journey to invest in US stocks from Mexico can be both exciting and rewarding. However, navigating the financial landscape can be complex. This comprehensive guide will help you understand the process, ensuring a smooth and successful investment experience.

Understanding the Basics

Before diving into the details, it's crucial to understand the basics of buying US stocks. Stocks represent ownership in a company, and buying stocks means you are purchasing a portion of that company's assets and earnings. When the company performs well, your stock may increase in value, providing potential returns.

Choosing a Broker

The first step in buying US stocks from Mexico is selecting a reliable brokerage firm. There are several reputable options available, including TD Ameritrade, E*TRADE, and Charles Schwab. When choosing a broker, consider factors such as fees, customer service, and available investment tools.

Opening an Account

Once you've chosen a broker, the next step is to open an account. This process typically involves filling out an application, providing personal and financial information, and agreeing to the broker's terms and conditions. Be prepared to provide identification documents and proof of address.

Understanding the Exchange Rate

When buying US stocks from Mexico, it's essential to understand the impact of exchange rates. Since you'll be purchasing US dollars, the exchange rate between the Mexican peso and the US dollar will affect your investment. Keep an eye on exchange rates to maximize your returns.

Selecting Stocks

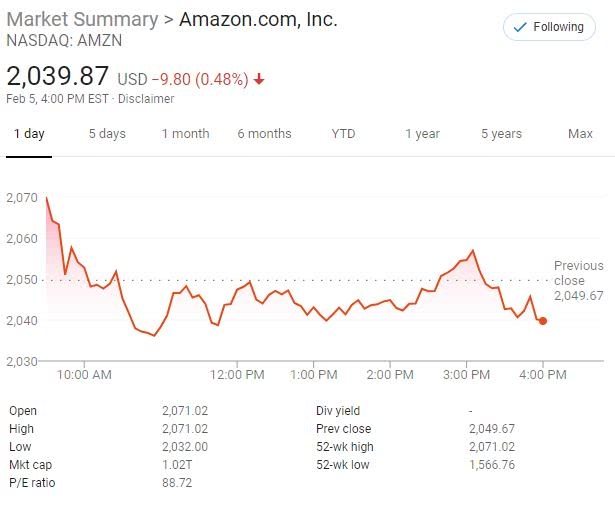

Once your account is set up, it's time to start selecting stocks. Consider factors such as the company's financial health, industry outlook, and potential growth opportunities. You can use investment tools and research provided by your broker to help make informed decisions.

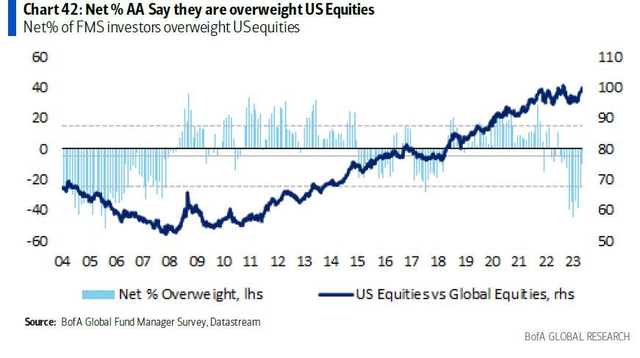

Diversifying Your Portfolio

Diversifying your portfolio is crucial to mitigate risk. Consider investing in a mix of sectors and asset classes to ensure your investments are spread out. This strategy can help you weather market fluctuations and maximize your returns.

Monitoring Your Investments

Once you've made your investments, it's essential to monitor your portfolio regularly. Keep an eye on the performance of your stocks and make adjustments as needed. Utilize the tools and resources provided by your broker to stay informed and make informed decisions.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario: you decide to invest

Conclusion

Investing in US stocks from Mexico can be a lucrative venture, but it requires careful planning and execution. By understanding the basics, selecting the right broker, and making informed investment decisions, you can increase your chances of success. Remember to monitor your investments and stay informed about market trends and economic indicators. Happy investing!

dow and nasdaq today